- WMarkets Insider

- Posts

- Your Boss Is the Market. And He’s Lying Again

Your Boss Is the Market. And He’s Lying Again

You Survived Lagos... So You Can Survive the Charts

You Know This Is Lagos

If you’ve ever had a 9 to 5 in Lagos, you already understand market manipulation, because you’ve survived it in real life.

They’ll hint at a salary raise right before month-end… then tell you “management is still reviewing” (Inducement)

They’ll call you out in front of the entire office for a client’s mistake they approved (Liquidity Grab)

One moment they’re sending motivational quotes to the team WhatsApp, the next moment, HR invites you for a “quick chat” (POI Reaction)

These Lagos bosses are basically live charts in suits.

And the madness doesn’t stop there:

Some will delay your leave for “critical deliverables”, then go on vacation themselves

Others will schedule 8AM meetings they don’t attend until 10:14AM

One even told his staff: “If you die, we’ll replace you. So don’t think you’re irreplaceable.”

Now read that again and tell me it’s not the same emotional manipulation the market uses before it makes the real move.

So today’s Saturday Value Drop isn’t just a list of setups.

It’s a playbook for trading like a survivor, someone who:

Waits out the market’s drama

Recognizes fake moves for what they are

Enters only when the manipulation is complete

Because whether it’s a manipulative boss or a manipulative market…

The only way to win is to stop reacting emotionally and start thinking like a sniper.

TRADE SETUPS BREAKDOWN

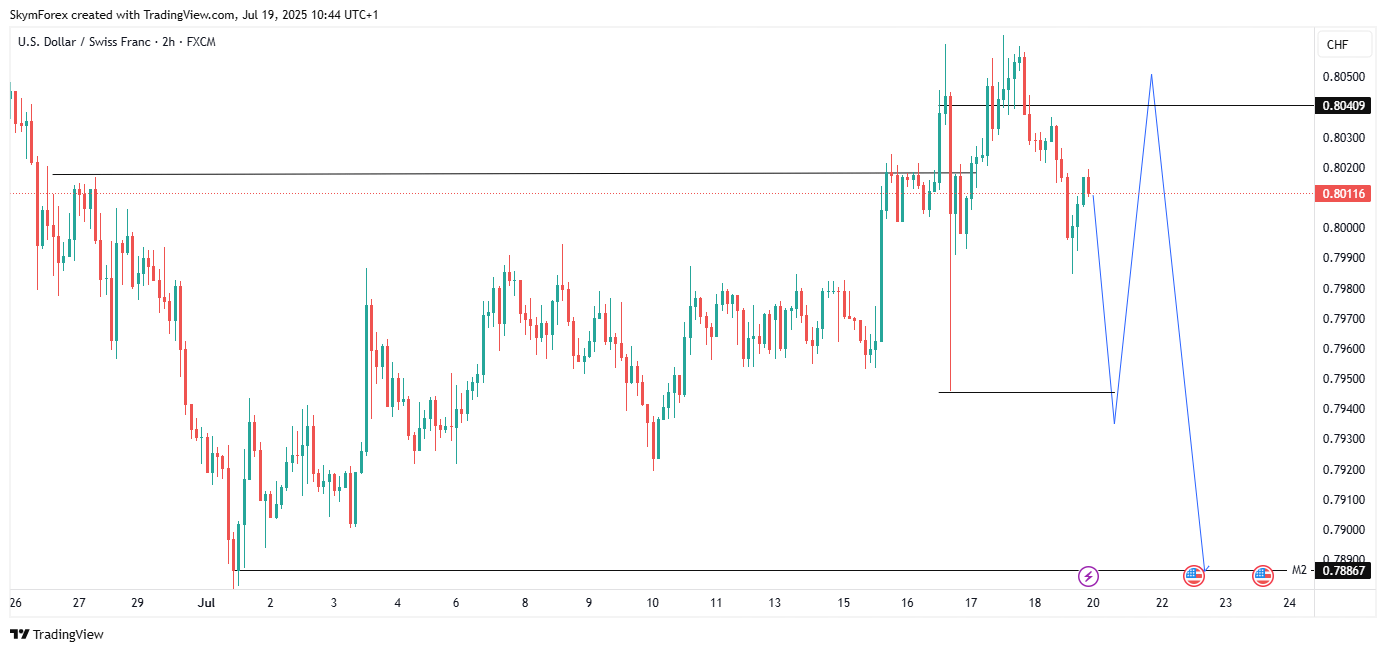

1. USD/CHF – Bearish Bias (2H)

USDCHF 2-HOUR CHART

Setup: Sell from 0.8040, TP at 0.78867

Manipulation Structure:

Inducement: Price tapped 0.8040 to tempt breakout traders with false bullish hope.

Liquidity Grab: The break above short-term equal highs absorbed early longs.

POI Reaction: Price is rejecting a supply zone where previous sell orders were initiated.

Narrative: Just like when your manager says “great work” but writes a poor appraisal; This bullish move is bait.

2. US30 – Bullish Bias (1H)

US30 1-HOUR CHART

Setup: Buy after retrace to 43,572, TP above 44,900

Manipulation Structure:

Liquidity Sweep: Sell-side liquidity cleared below local lows.

Inducement: The retrace tempts sellers, but it’s prepping to tap demand.

POI Reaction: Bullish order block at 43,572 expected to respond with aggressive buying.

Narrative: Don’t fall for the panic emails; The retrace isn’t failure. It’s HR covering up their mess before the real rally.

3. BTC/USD – Bullish Bias (1H)

BTCUSD 1-HOUR CHART

Setup: Buy from 115,898, TP at 122,582

Manipulation Structure:

Inducement: Bearish pressure tricks traders into shorting the drop.

Liquidity Grab: Stop hunts beneath minor support levels.

POI Reaction: Demand zone near 115,898 aligning with bullish structure continuation.

Narrative: Like a toxic boss faking a shutdown just before payroll, this “dip” is manipulation before the real move.

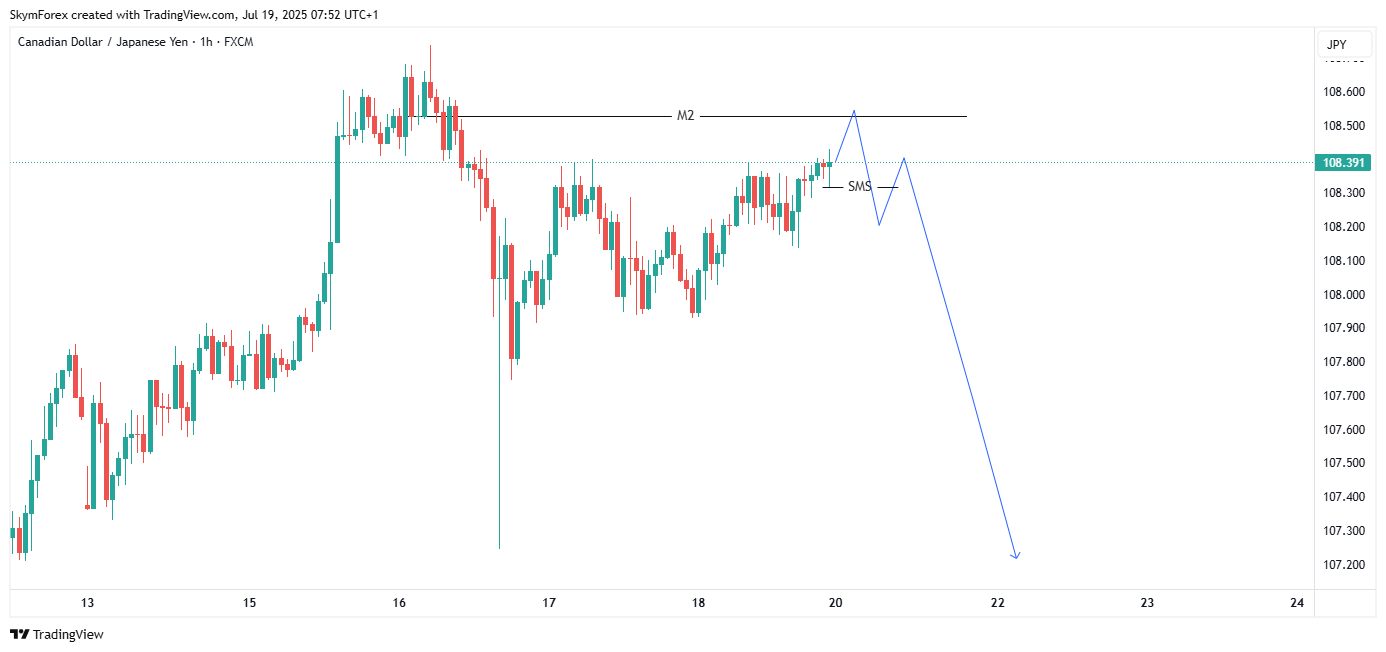

4. CAD/JPY – Bearish Bias (1H)

CADJPY 1-HOUR CHART

Setup: Sell from 108.580, TP at 107.300

Manipulation Structure:

Inducement: Price formed a clean trendline to build short-term bullish confidence.

Liquidity Grab: Spike above highs swept buy-side liquidity.

SMS Confirmation: Structure Market Shift confirms bears are back in charge.

Narrative: That last-minute Friday “all hands” meeting was never for praise, just like this fake pump wasn’t a breakout.

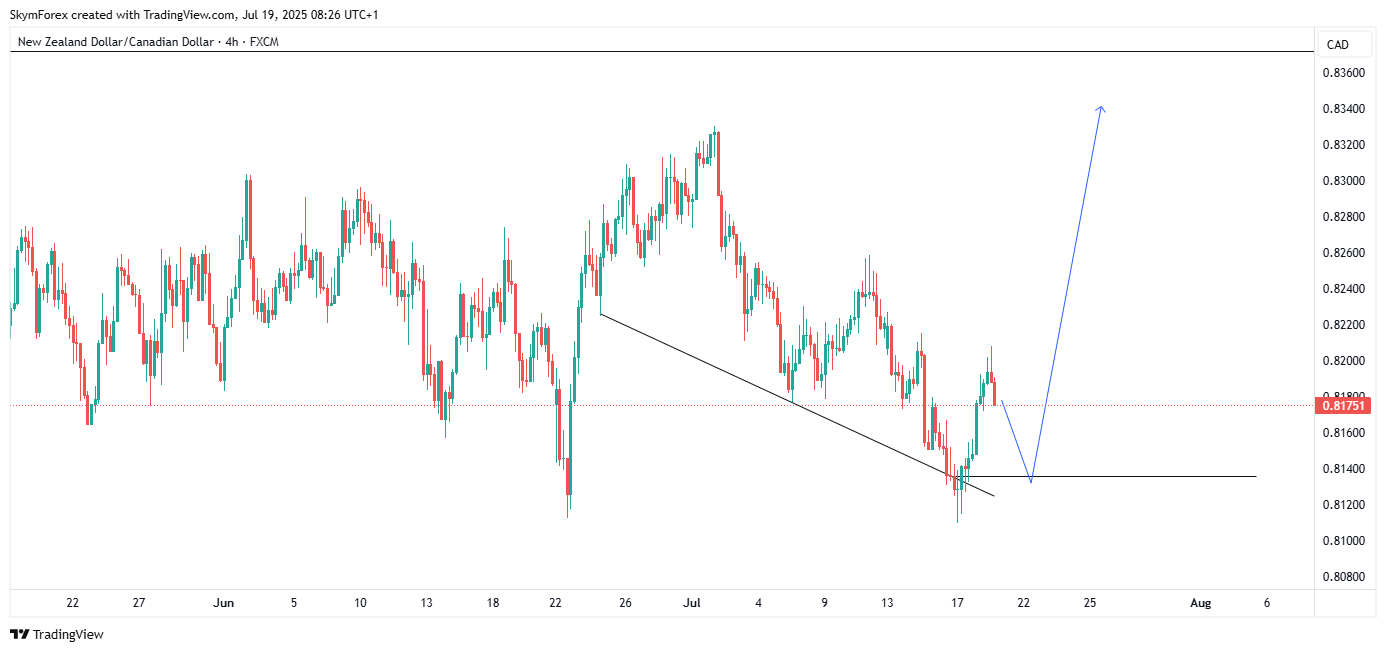

5. NZD/CAD – Bullish Bias (4H)

NZDCAD 4-HOUR CHART

Setup: Price drops from 0.81751, buy at 0.81390

Manipulation Structure:

Inducement: Price dips into a well-known support zone where breakout sellers load up.

Liquidity Grab: Grabs sell-side liquidity below prior lows.

POI Reaction: 0.81390 = clean demand zone where smart money waits.

Narrative: They set you up with unreachable KPIs, wait for you to slip, then pretend to “give feedback”, now flip it on the charts and buy after their trap.

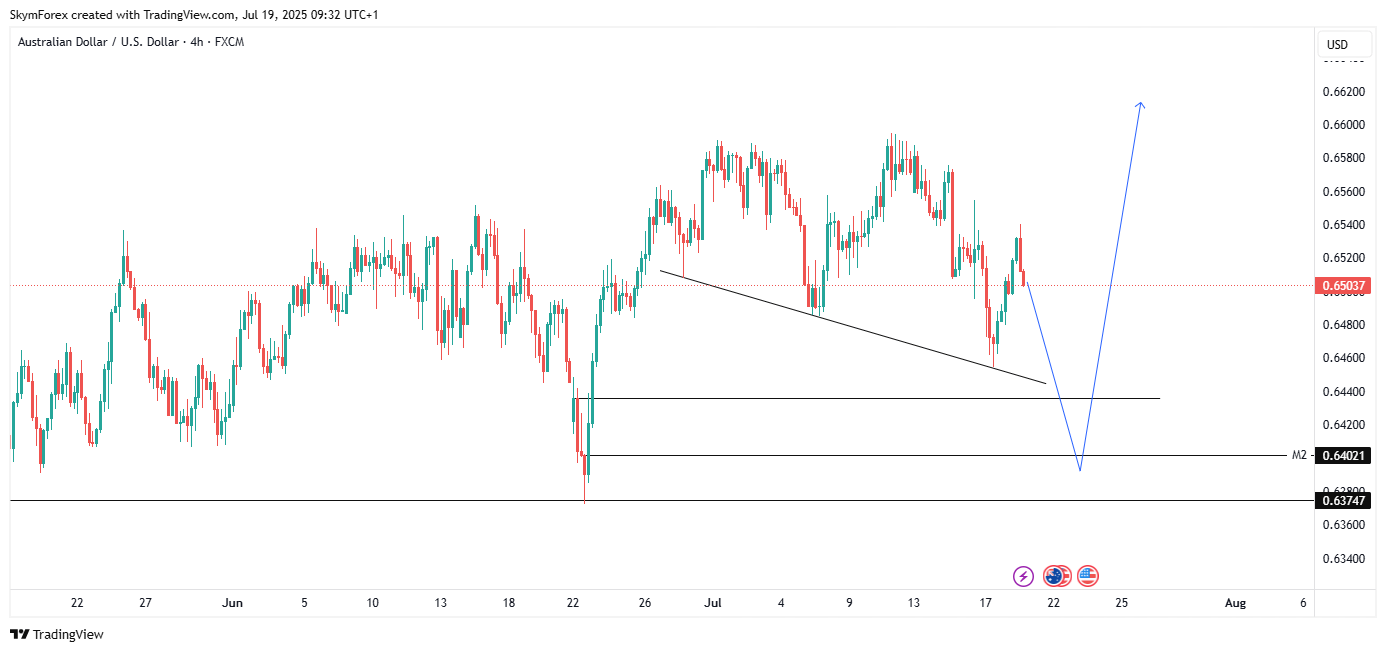

6. AUD/USD – Bullish Bias (4H)

AUDUSD 4-HOUR CHART

Setup: Price drops from 0.65037, buy at 0.64021

Manipulation Structure:

Inducement: Bears enticed by clean lower highs.

Liquidity Grab: Equal lows under attack, stop hunts galore.

POI Reaction: Bullish OB sits at 0.64021, ready to trigger demand-fueled reversal.

Narrative: When they send you to represent the company without giving you a budget, that’s inducement. The smart trader waits until the setup’s funded.

What To Do:

Mark the exact entry zones

Wait for confirmation candles

Don’t hope. React to the market. Not to your emotions.

What's Next?

Watch out for Monday’s Fundamental Outlook

We’ll break down high-impact news events and central bank activity, plus how to position ahead of them like a real pro.

Until then...

Trade clean. Trade smart. Leave the stress to your old boss.

—

Mr. Pips

Market Technician & Trader Psychology Coach

WMarkets Insider

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary