- WMarkets Insider

- Posts

- WMarkets Weekly Outlook

WMarkets Weekly Outlook

Hello Family,

As markets awaken to a post-NFP hangover on this September 6, 2025 Saturday, value hunters eye battered assets for rebound plays.

Could these dips forge the next leg up?

Let's dive into technical breakdowns of EUR/USD, GBP/AUD, S&P 500, GBP/JPY, and Gold, unpacking candlestick patterns, key levels, and trend dynamics amid data-driven volatility.

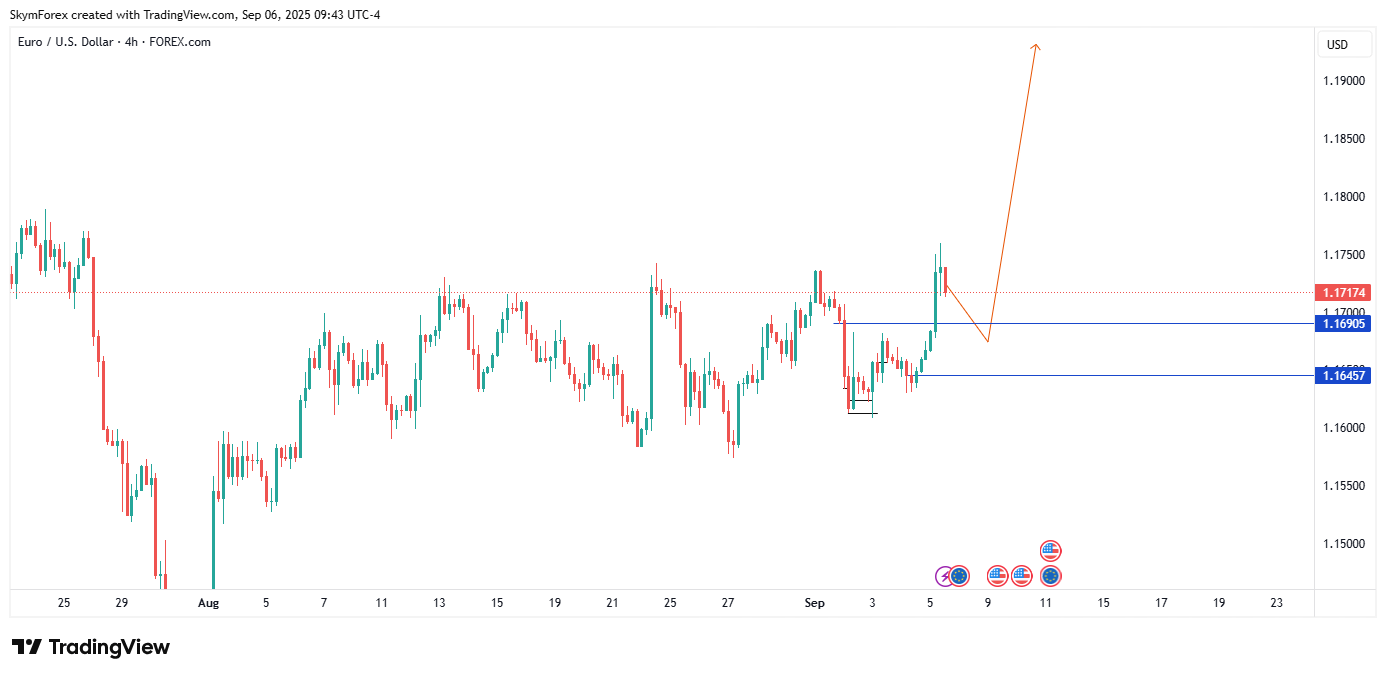

1. EUR/USD

4-Hour Chart

Bearish impulse broke 1.1774 resistance, found support at 1.16457 with a V-shaped reversal, and projects a bullish channel toward 1.1900 if 1.16905 breaks.

Bias for the Week: Long, contingent on holding 1.16457 and breaking 1.16905, with US CPI (Sept 11) as a catalyst.

Risk: Downside to 1.1600 if support fails.

Key Levels: Support 1.16457, Resistance 1.1900.

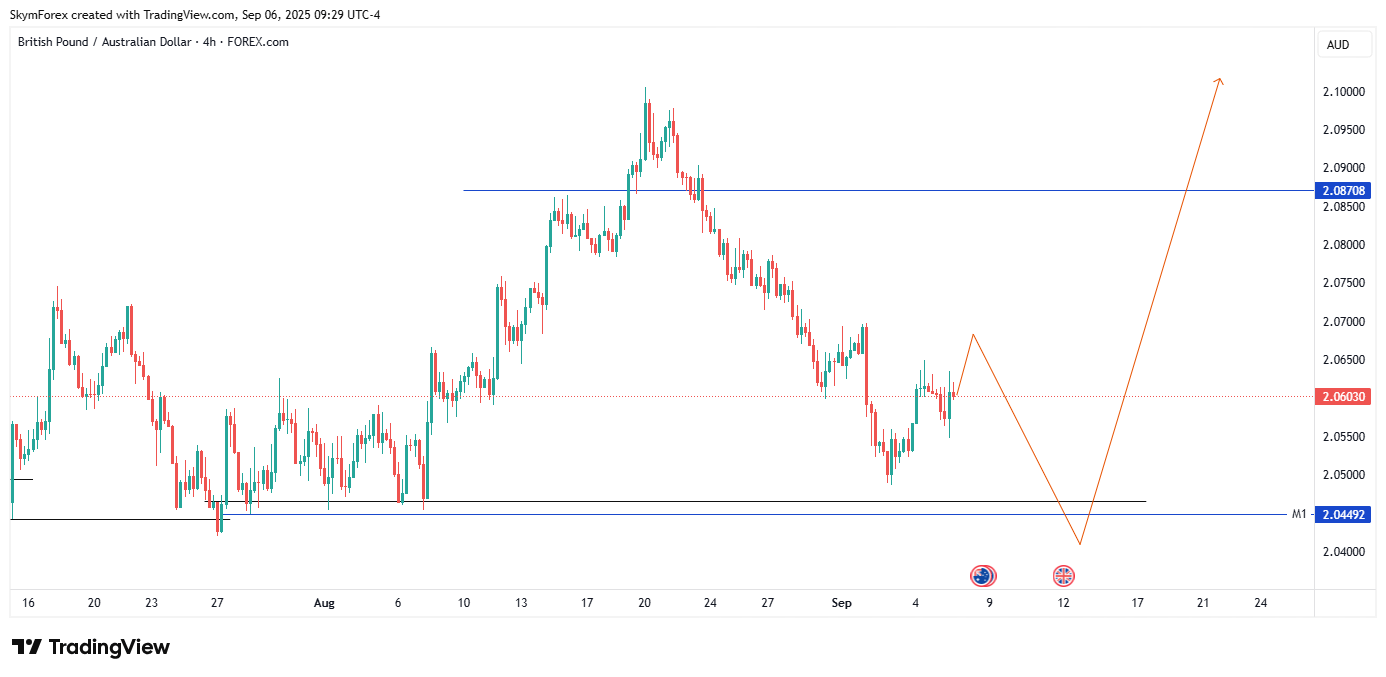

2. GBP/AUD

4-Hour Chart

Head-and-shoulders top broke 2.06030 support, formed a double bottom at 2.04492, with a bullish flag targeting 2.08708.

Bias for the Week: Long, if 2.06030 is reclaimed, supported by UK data (Sept 12) and Australian releases (Sept 9).

Risk: Retest of 2.04000 if reversal falters.

Key Levels: Support 2.04492, Resistance 2.08708.

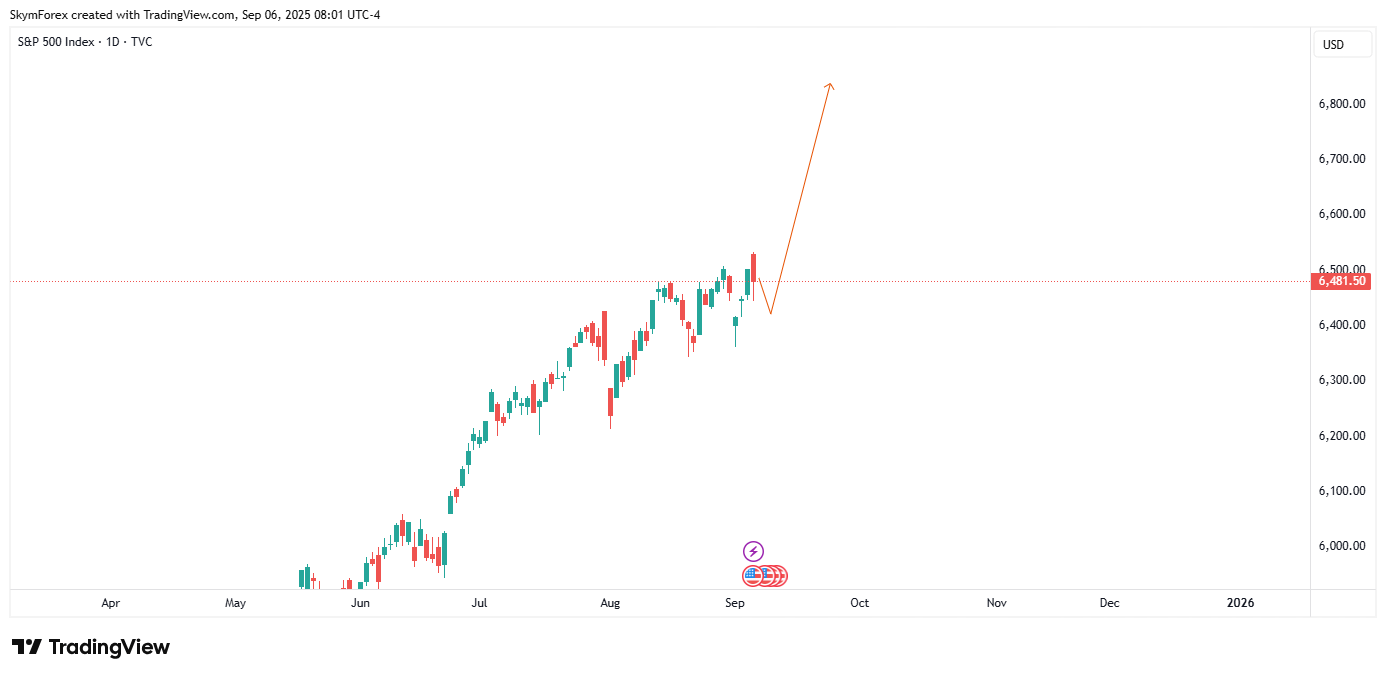

3. S&P 500

1-Daily Chart

Pullback from 6,481.50 formed a bullish harami at 6,400.00, with an uptrend projection to 6,800.00 if support holds.

Bias for the Week: Long, above 6,481.50, with CPI (Sept 11) influencing momentum.

Risk: Drop to 6,200.00 if 6,481.50 breaks.

Key Levels: Support 6,400.00, Resistance 6,800.00.

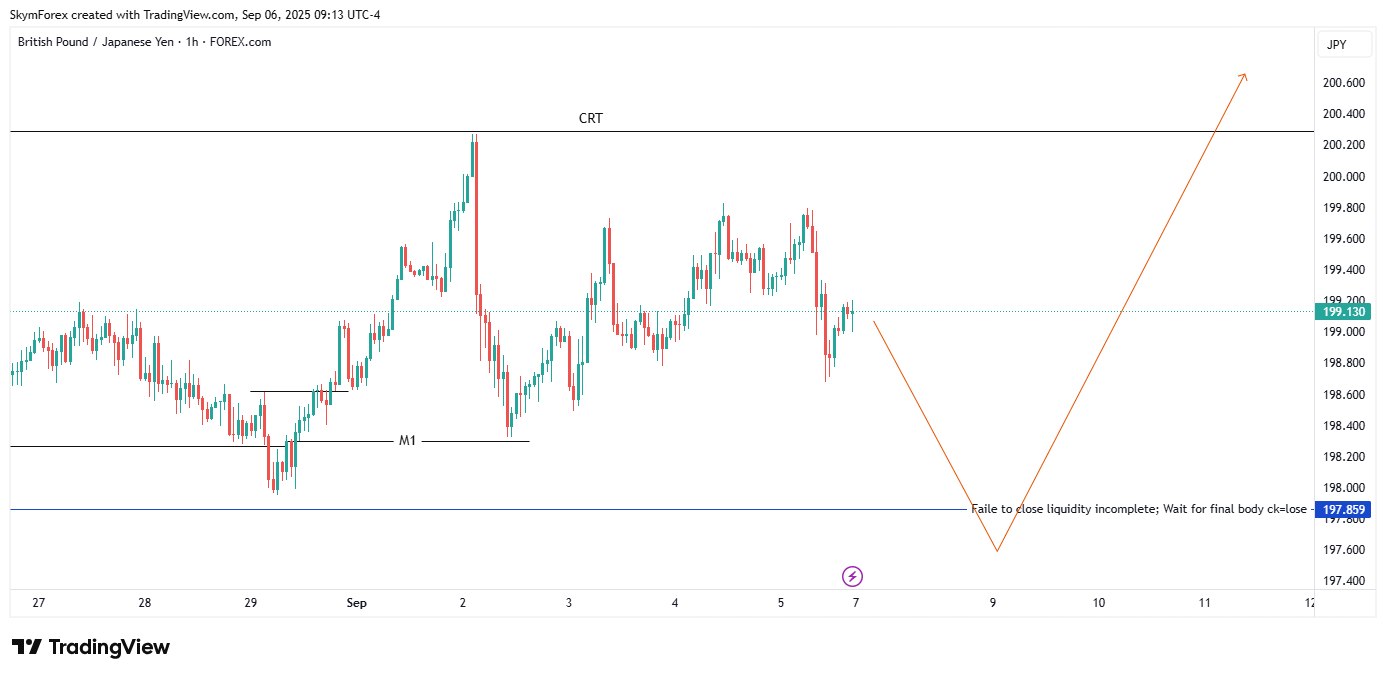

4. GBP/JPY

1-Hour Chart

Breakdown from 199.130 hit 197.857 with a V-bottom, projecting a sharp rise to 200.000 if 199.130 clears.

Bias for the Week: Long, pending breakout above 199.130, with Japan GDP (Sept 7) as a trigger.

Risk: Further decline to 197.000 if momentum stalls.

Key Levels: Support 197.857, Resistance 200.000.

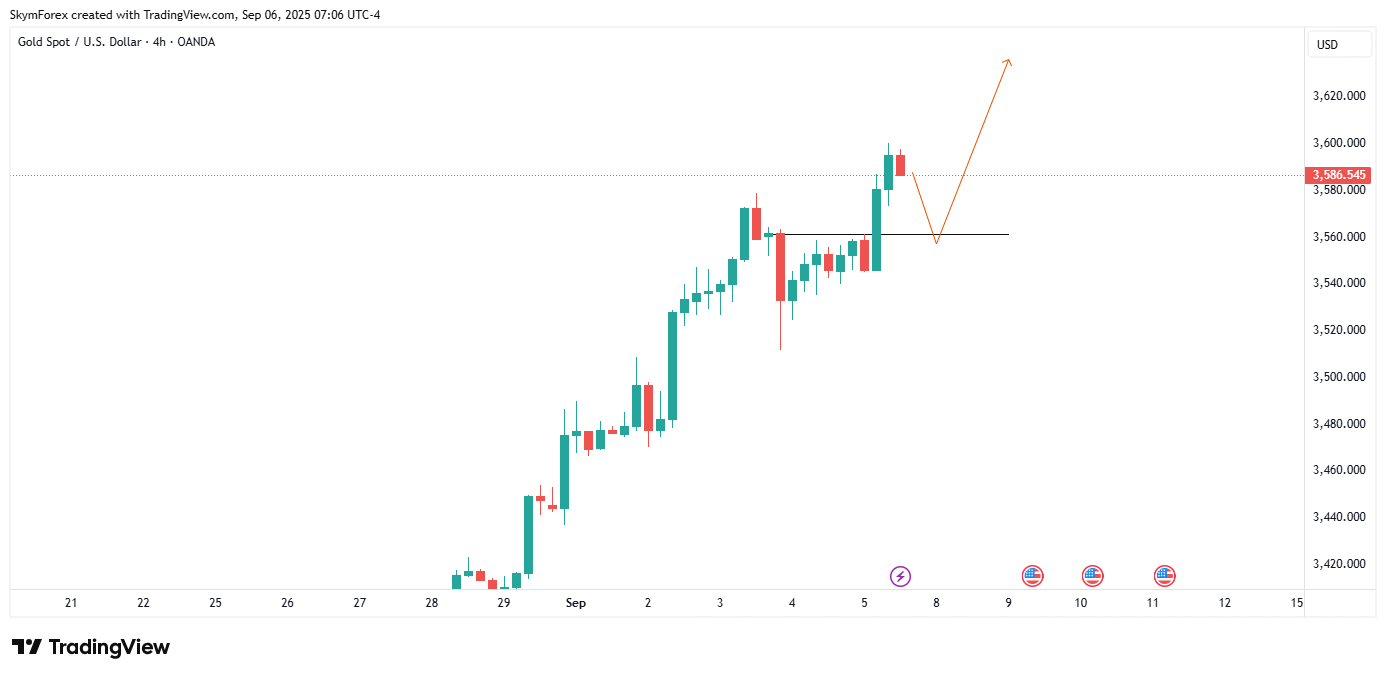

5. Gold (XAU/USD)

Descending wedge from 3,586.45 found support at 3,420.00, with a morning star hinting at a breakout to 3,620.00.

Bias for the Week: Long, if 3,420.00 holds, driven by US CPI (Sept 11).

Risk: Correction to 3,300.00 if support breaks.

Key Levels: Support 3,420.00, Resistance 3,620.00..

Best regards,

Mr. Pips

Senior Financial Market Analyst, WMarkets

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary