- WMarkets Insider

- Posts

- This Setup on EURUSD Might Be the Trap of the Month

This Setup on EURUSD Might Be the Trap of the Month

Also, here’s why Oil traders should chill until this level breaks.

First, Pause. Breathe. Zoom Out.

You ever look at a setup and it looks too perfect?

Clean trendline. Beautiful wedge. Everything screaming “Buy now!”

That’s exactly how EURUSD is looking right now, and that’s why you need to slow down before rushing in.

Let’s break it down

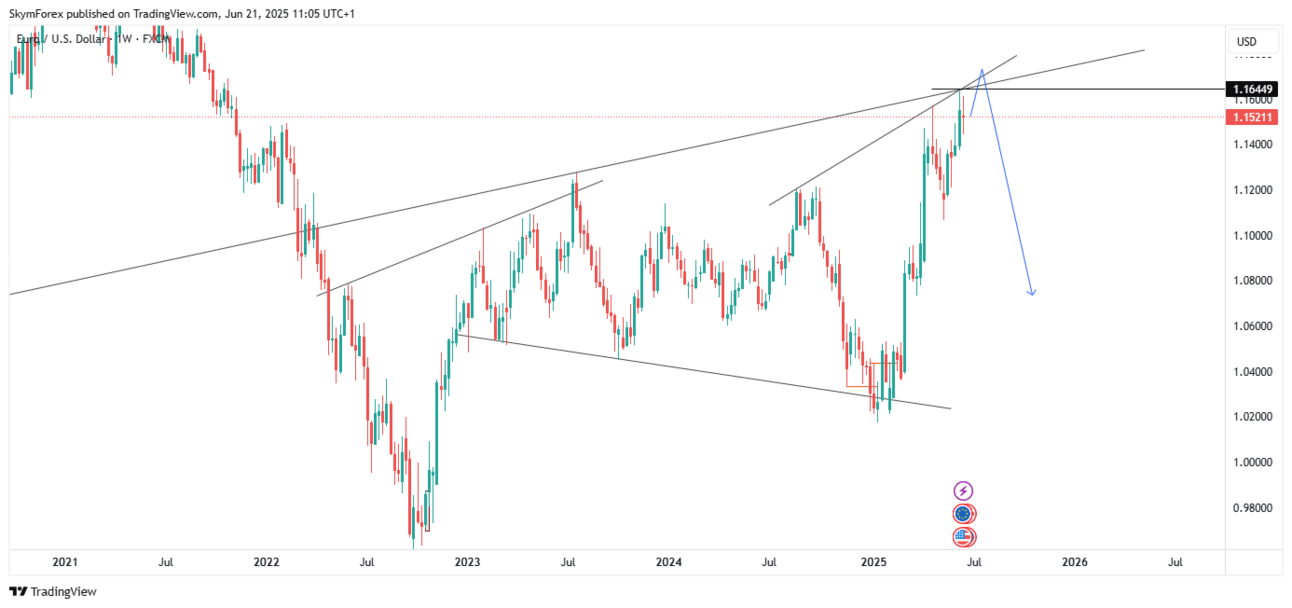

EURUSD 1-WEEKLY CHART

EURUSD Weekly Chart -A Textbook Trap?

I just dropped this inside the chart room, but if you missed it, here’s the juice:

EURUSD is sitting under a key resistance level at 1.1645, where a multi-year trendline, wedge top, and previous rejection zone all meet.

Most traders see this and go,

“It’s breaking out! Buy the breakout!”

But let me ask you this, why would smart money let you win that easy?

What we’re likely seeing is a liquidity grab, price might poke above 1.1645 to hunt SLs and then dive.

Fundamentals Back It Up

Eurozone PMI came in weak.

USD is strengthening on the back of strong retail and inflation data.

ECB isn’t doing much, while the Fed is still flexing its hawkish tone.

Mr. Pips’ Bias:

Sell the rejection below 1.1645.

First target: 1.1300

Ultimate target: 1.08 zone

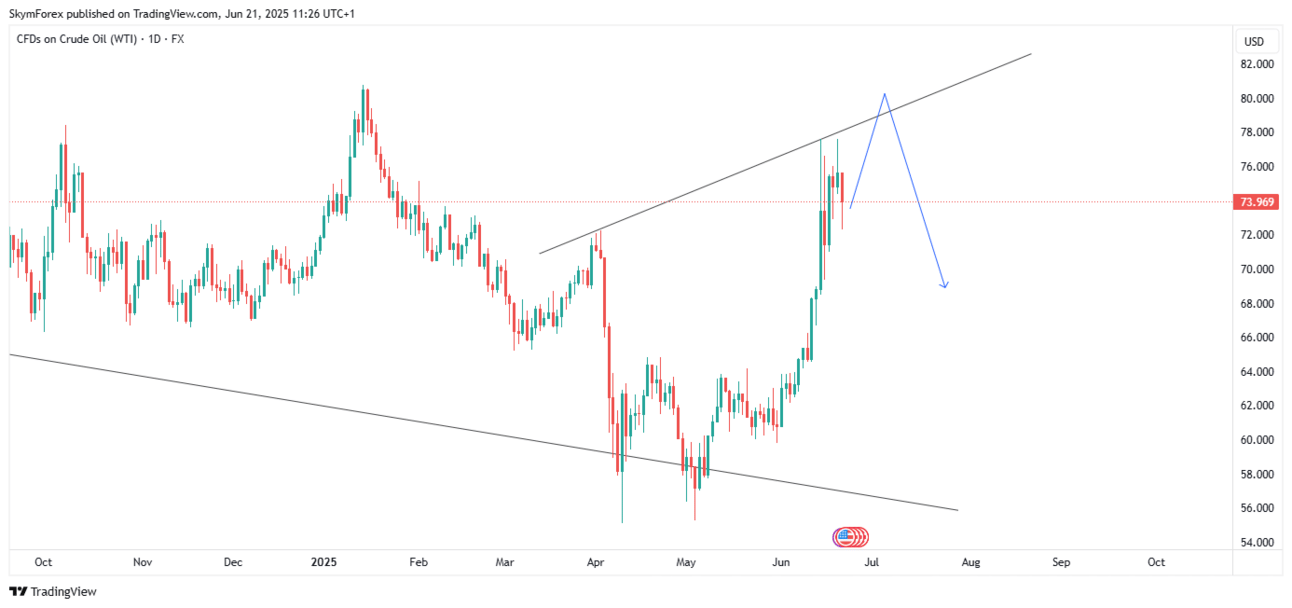

USOIL (WTI) -Don’t Chase Yet

Oil traders, listen up.

Crude is stuck between $77 and $82.50, bouncing around like a drunk scalper on Friday NFP.

USOIL 1-WEEKLY CHART

The fundamentals are wild:

Israel-Iran tension is still hot.

OPEC+ might cut or pump, no one knows.

Dollar strength is keeping pressure up, but oil hasn’t broken down.

Translation:

Don’t trade like you’re trying to guess the next OPEC tweet.

Wait for a clean break:

✅ Above $82.50? We might see $86+

❌ Below $77? Back to $75 and beyond

Today’s Trading Wisdom

“The market doesn’t reward the early — it rewards the patient sniper.”

If you want to improve, stop trying to predict fireworks and start reacting to structure.

Backtest. Wait for confirmation. And when it comes? Go in with a clear plan.

Ready to Level Up?

We’ve reloaded your asset list -EURUSD, USOIL, and 300+ pairs are ready to be added.

And yes, the 100% Deposit Bonus is still active:

What To Do Now (Before the Next Drop)

1. Add EURUSD and USOIL to Your Watchlist

These two are cooking right now, and when they move, they move big.

Focus less on guessing direction, more on reacting to key levels (1.1645 for EURUSD, $82.50 for Oil). That’s where the smart entries are.

2. Backtest Your Strategy Like a Professional

Still trading vibes? Fix that.

Take 1 strategy. Run it through 20–30 past trades. Log your data. Find your edge.

3. Double Your Firepower with a 100% Bonus

You’ve got the plan. Now fund it.

We’re still giving 100% deposit bonuses for a limited time — which means twice the trading power without needing twice the capital.

4. Whitelist This Email Now

You do not want to miss next Saturday.

Here’s how to make sure it lands in Primary, not Promotions:

Check your Promotions or Spam folder

Tap the 3 dots (top right corner of the email)

Click Move to → Primary

5. Invite One Trader Who Needs to Hear This

Forward this to someone who's one loss away from quitting.

Let them know: Mr. Pips said it’s not over — you’re just one good setup away from snapping back.

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary

The guy who’s blown enough accounts for both of us.