- WMarkets Insider

- Posts

- They Cut His Head. Gold Spiked $100.

They Cut His Head. Gold Spiked $100.

War stories aren’t just headlines. They move the market.

Monday Morning Briefing: From the Desk of Mr. Pips

“They cut his head, and the markets flinched.”

Not a movie. Not a metaphor.

Last Friday, Iranian-backed forces executed a high-level Israeli intel asset in Syria.

Within hours:

Gold surged.

Oil tightened.

The Dollar flipped bullish.

So no, this isn’t just politics. It’s price action written in blood.

And most retail traders?

Still drawing trendlines, completely unaware the market had been hijacked by global politics. And if you're not paying attention, you'll be the last one in when the next spike hits.

Let’s rewind the chart for a minute, but not to 2024.

We’re going way back.

The Iran-Israel Conflict: A Brief (and Brutal) History

Iran and Israel aren’t just having a disagreement.

They’re in an undeclared war — and it’s been boiling for decades.

Let me give it to you like a docuseries (without the Netflix subscription):

Iran funds proxies: Hezbollah, Hamas, militias in Iraq/Syria.

Israel responds with surgical airstrikes, assassinations, and cyberattacks.

The U.S. steps in — not for peace, but for power.

Meanwhile, oil traders are watching the Strait of Hormuz like hawks. That’s the artery through which 20% of the world’s oil flows. Iran can disrupt it in one phone call.

That’s why when heads roll, charts spike.

One missile lands there? Crude goes parabolic.

Why the U.S. Is Always on Team Israel

Let’s keep it simple:

Strategic ally: Israel is the U.S.'s strongest foot soldier in the Middle East.

Military tech exchange: Think Iron Dome meets Wall Street funding.

Oil & control: Keeping Iran unstable indirectly helps the U.S. maintain influence over Gulf oil routes.

Election optics: Presidents don't want to look “soft” on Iran.

So anytime things get hot in the Middle East, Uncle Sam shows up with money, weapons, and media coverage — and the Dollar reacts accordingly.

So What Does This Mean for You — the Trader?

Let’s talk real trades.

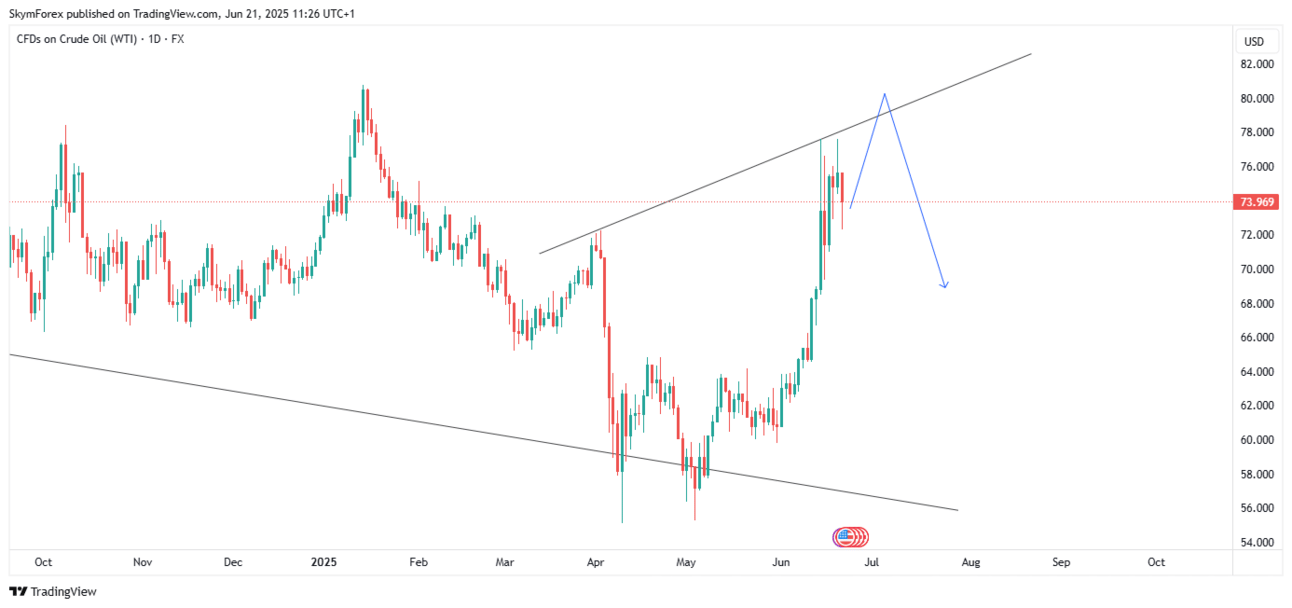

1. USOIL (Crude Oil)

Crude loves conflict.

Especially when there’s potential disruption in Iranian exports or shipping routes.

USOIL 1-DAILY CHART

Expect bullish momentum to continue

Watch resistance at $82.50 — if broken, we could see a fast run to $86. Maybe $88 if things get hotter

SL under $77 — but watch for volatility spikes during Asian/NY overlap

If it breaks below $77, the narrative shifts

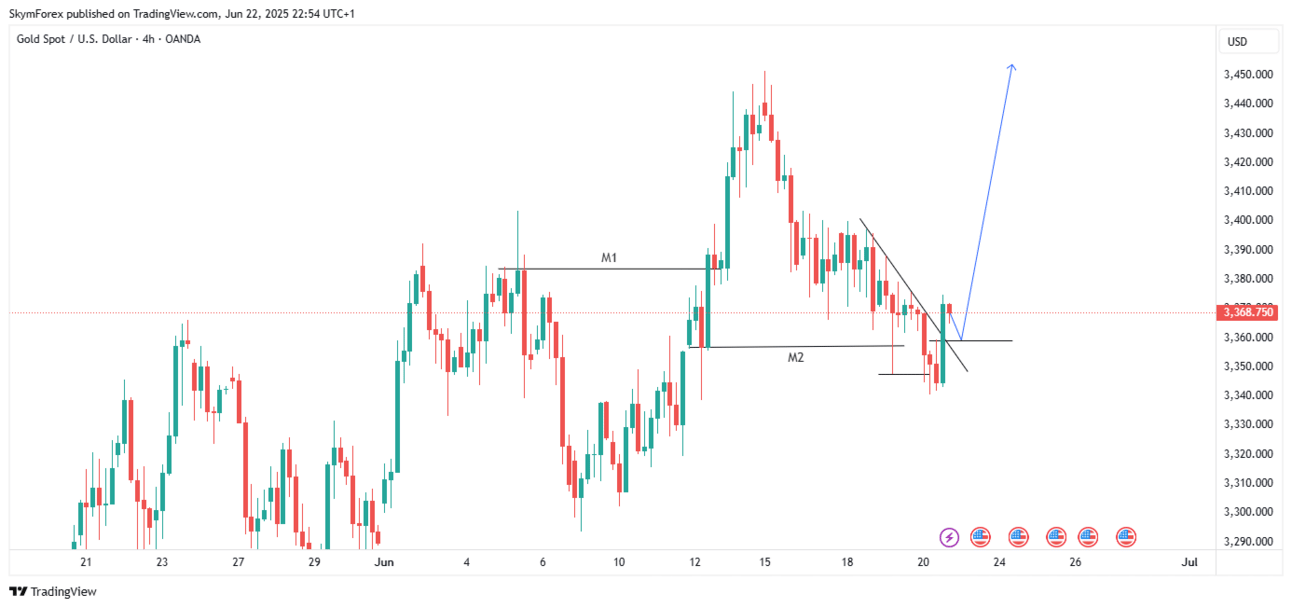

2. XAUUSD (Gold)

Gold is doing what gold does -absorbing fear.

Add USD softness and boom: a rocket candle.

GOLD 4-HOURLY CHART

Look for a push toward $3500 if headlines worsen

Support zone: $3340–$3360 (buy dips only if conflict escalates)

Avoid entering on emotional candles, wait for NY session structure

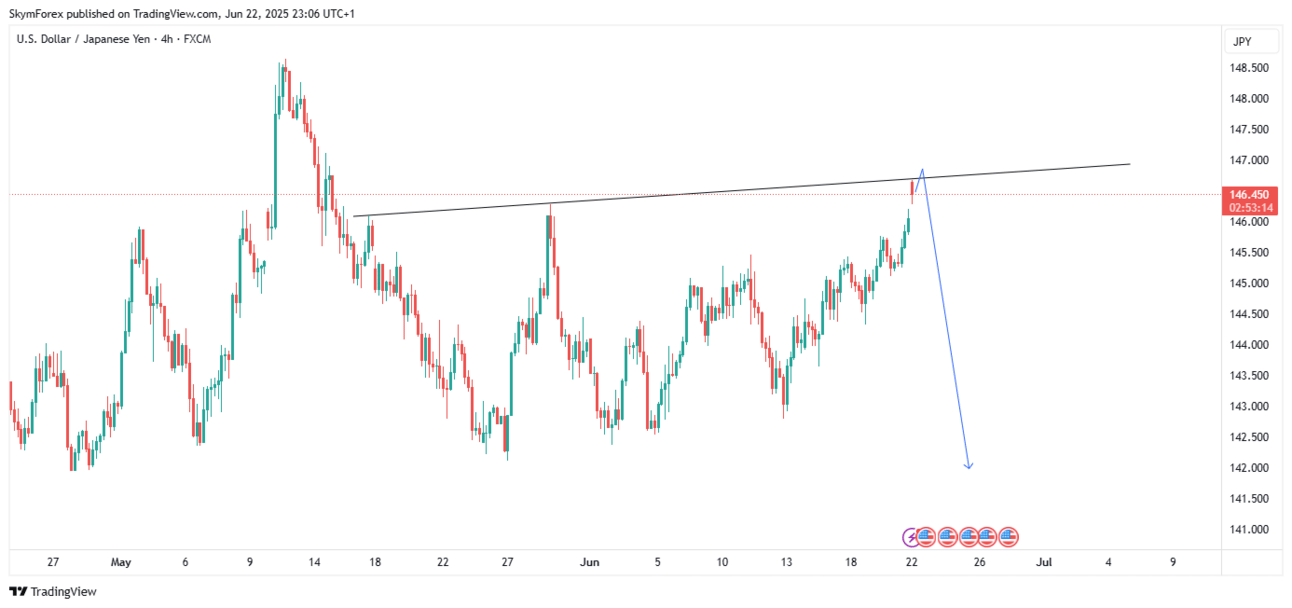

3. USDJPY (Safe haven vs. safe haven)

This pair gets funky during geopolitical turmoil.

If oil spikes and yields drop, JPY strengthens faster than a funded trader on FOMC week.

USDJPY 4-HOURLY CHART

Bias: Heavy downside

Watch for short entries below 147.00

Don’t trade this pair without checking Treasury yields — seriously

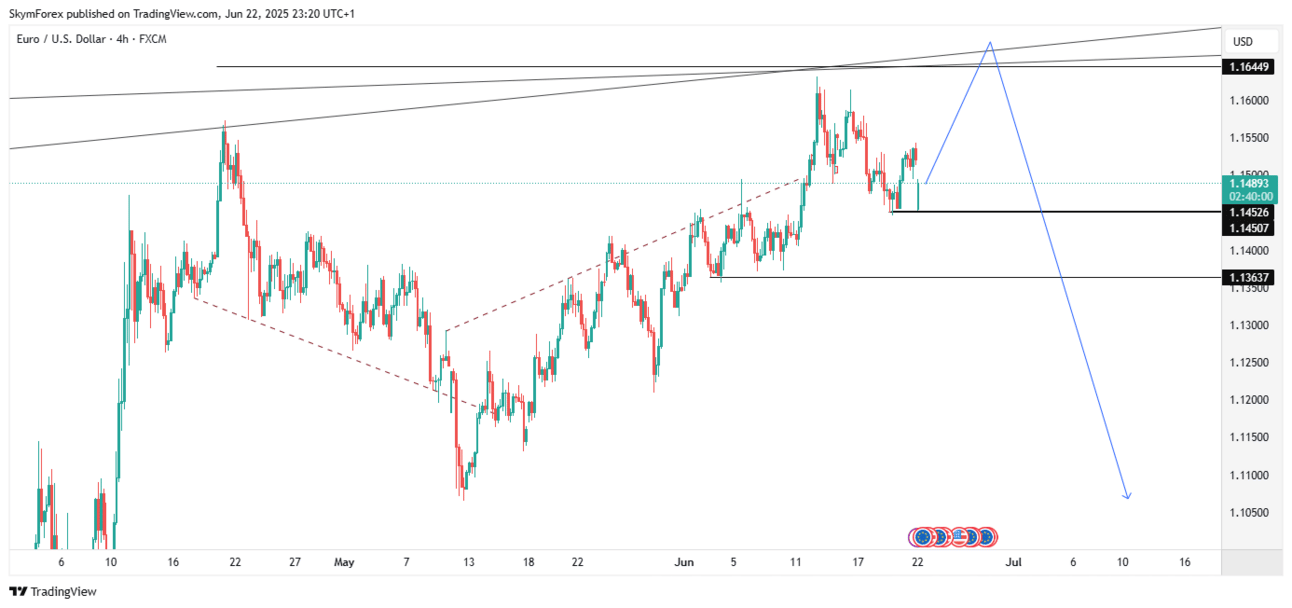

4. EURUSD

Caught in the middle. EU stays quiet during conflict but suffers the inflation blowback.

EURUSD 4-HOURLY CHART

Bias: Bearish under 1.1676

Target: 1.1300

A strong Dollar and oil rally = euro pain

Don't Be the Trader Who Sleeps on Fundamentals

This isn’t just “news.” This is market structure on a global scale.

Every candle you see this week is reacting to:

War headlines

Oil supply chains

Central bank tone shifts

Fear vs. greed

And if you ignore it? You’ll be trading a chart that doesn’t make sense.

What To Do Before the Chart Moves

1. Mark Key Levels Now

EURUSD: 1.1676 / 1.1300

USOIL: 82.50 / 86.00

XAUUSD: 3360 -3340/ 3500

USDJPY: 147.00 / 142.00

2. Add the Assets You’re Missing

Tap “+” on your platform → Scroll to Preliminary → Add the missing pairs.

There are 300+ assets, including gold, oil, and major safe havens.

3. Fund & Use the Bonus

Markets move fast during global tension. Use the 100% deposit bonus to give yourself margin to breathe — not overleverage.

4. Share This With Your Trading Circle

Some traders are about to walk into gold and oil like they’re playing demo. Don’t let that happen. Forward this to your squad. You’ll look like a prophet.

See you Saturday.

If oil hits $86 before then… you know why. 😏

—

Mr. Pips

The guy who watches war maps and market gaps.

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary