- WMarkets Insider

- Posts

- Signals? What could possibly go wrong?

Signals? What could possibly go wrong?

Honestly, what’s the worst that could happen?

You follow the setup.

You respect your risk.

You wait for confirmation.

You enter with sniper-like precision...

…and the market turns around like it forgot to pay NEPA.

Classic.

This week’s Saturday Value Drop is here to help you stop getting humbled by fakeouts and start reading the market like you paid its school fees.

Let’s break down the setups that look good, smell like opportunity — but only pay if you know what to wait for.

Ready for the technical breakdowns?

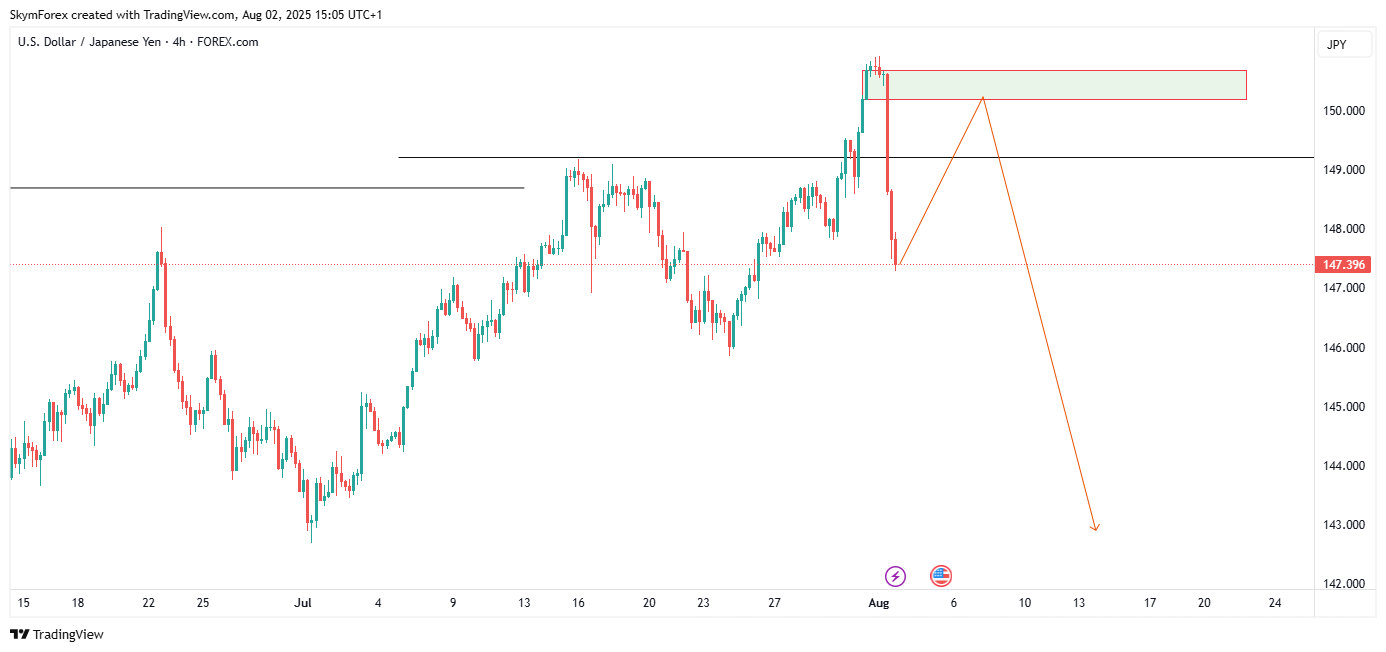

1. USDJPY

USDJPY’s been acting like that guy who swears he’s “done with the streets”… then shows up at the streets again.

USDJPY: 4-HOUR CHART

After last week’s FOMC drama, price wicked into a previous supply zone and immediately chickened out, classic inducement behavior. But the bigger game? A juicy POI around 156.20. That’s the area where bulls either prove their loyalty… or get dumped for good.

Watch for:

A clean retest of 155.60 before a potential move higher

Or a manipulation spike into 156.20 before a nosedive

Fundamentals still favour USD strength, but don’t marry it yet. Just date casually.

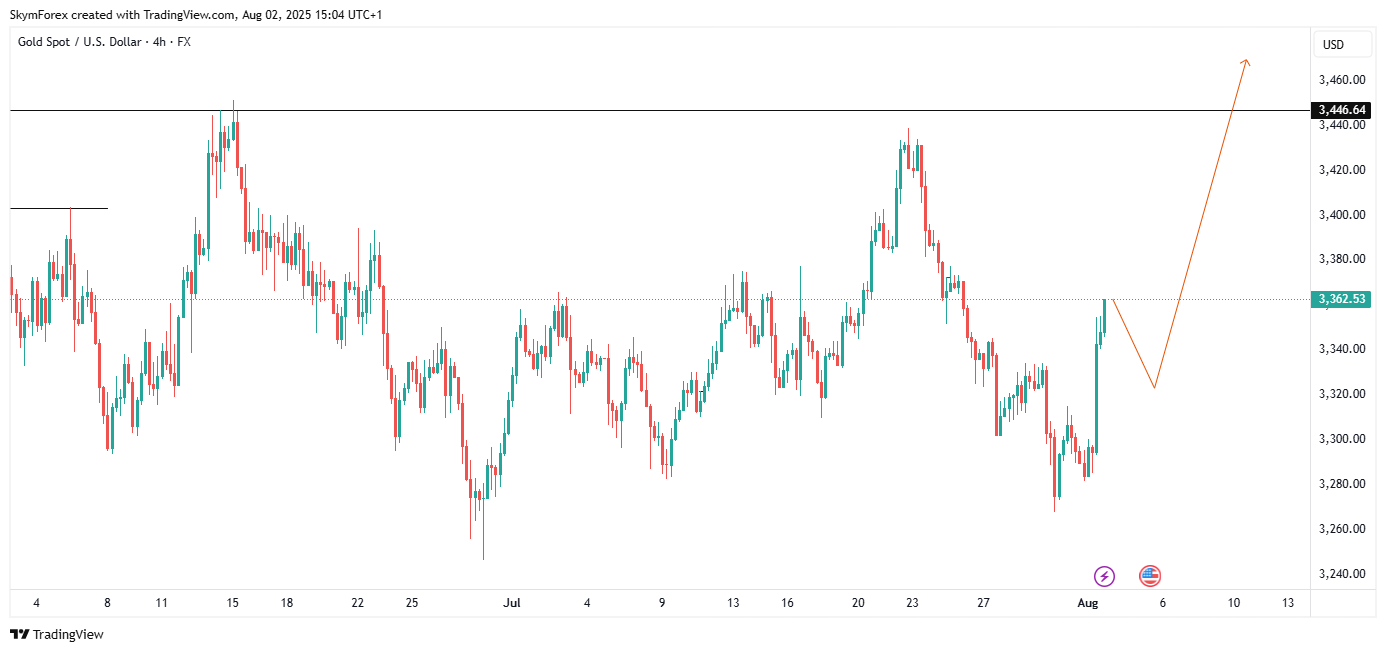

2. XAUUSD

Gold thinks it’s still the safe haven everyone wants… even when nobody’s calling anymore.

XAUUSD: 4-HOUR CHART

After NFP showed the U.S. labor market is still pumping iron, you'd think Gold would accept it’s not its season. But no, it's lingering around key zones like it’s waiting for an apology.

Here’s what matters:

1970–1980 is the heartbreak zone. If price can’t break it with force, expect rejection.

A clean breakdown below 1955 and we may be heading back to the friendzone (a.k.a 1920).

Technically, it’s screaming for a sell, but wait for that emotional breakdown first.

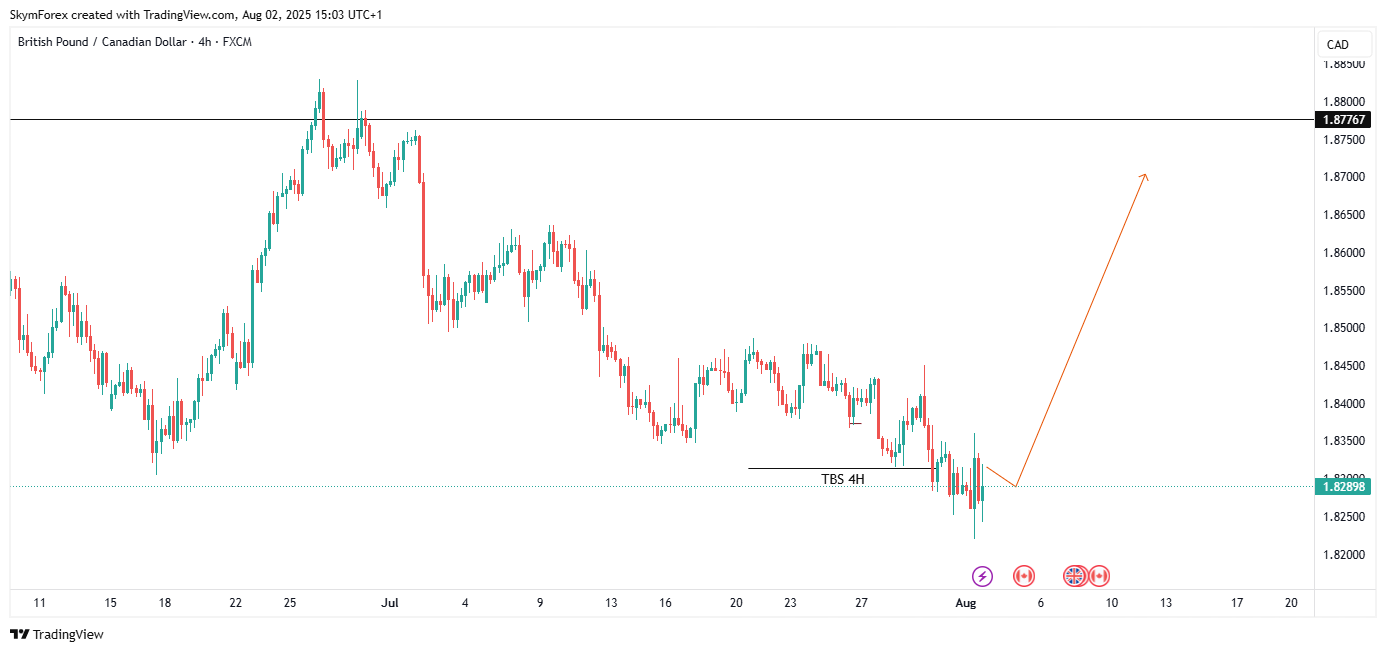

3. GBPCAD

While everyone’s watching flashy pairs, GBPCAD is minding its business and building a very suspiciously clean structure.

GBPCAD: 4-HOUR CHART

You see that demand zone at 1.7450? Yeah, that’s where price has bounced three times now, and each time with more confidence than your last mentor promising “8% weekly returns.”

The play?

Break and retest above 1.7550 = potential long continuation.

Drop below 1.7450 = grab your popcorn. Bears might be in for a show.

Also, oil prices and CAD strength are whispering in the background, keep your ears open.

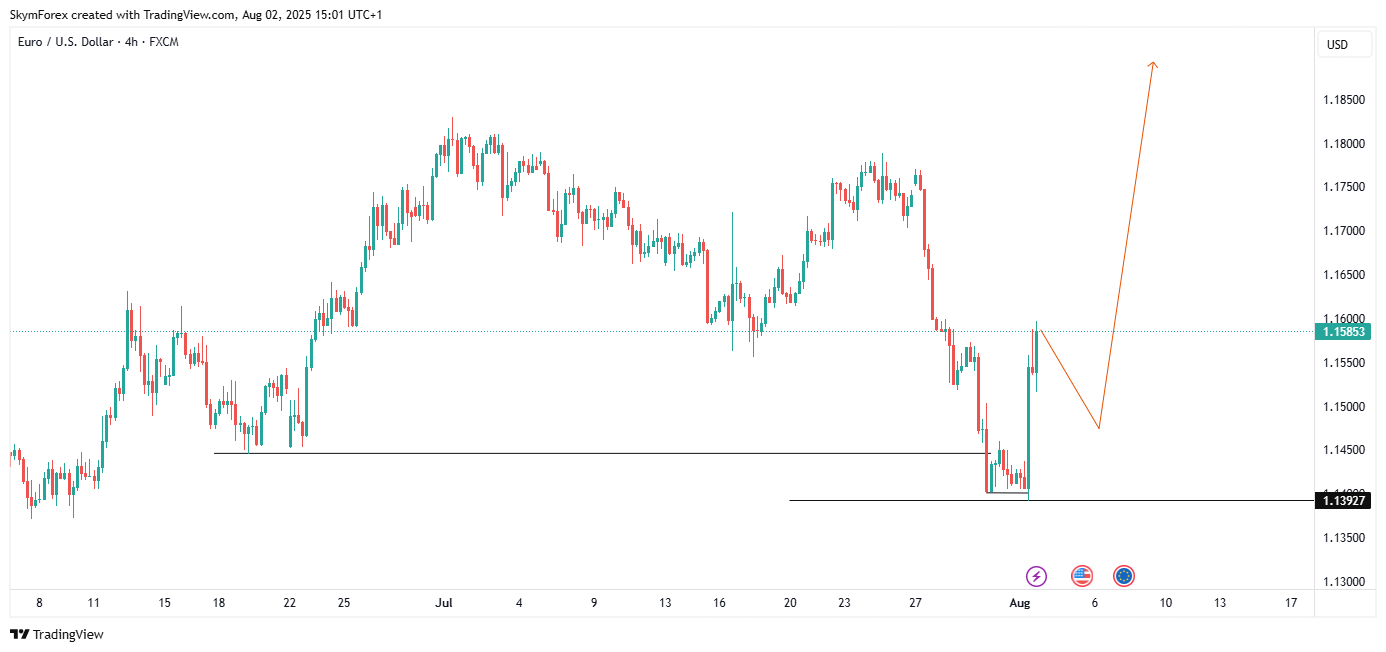

4. EURUSD

EURUSD has been quiet lately… too quiet.

Like a telenovela character that fakes their death, you just know it’s about to storm back with a plot twist.

EURUSD: 4-HOUR CHART

The plan? A little pullback to the 1.15000 level, the emotional support zone where it finds its confidence before staging a dramatic rally back upward.

Expect:

A fake sell-off to grab liquidity

A clean reversal off 1.15000

Dollar weakness + macro-optimism from the eurozone could be the perfect mood booster

Don’t chase it like your last bad trade. Wait for the pullback, then join the redemption arc.

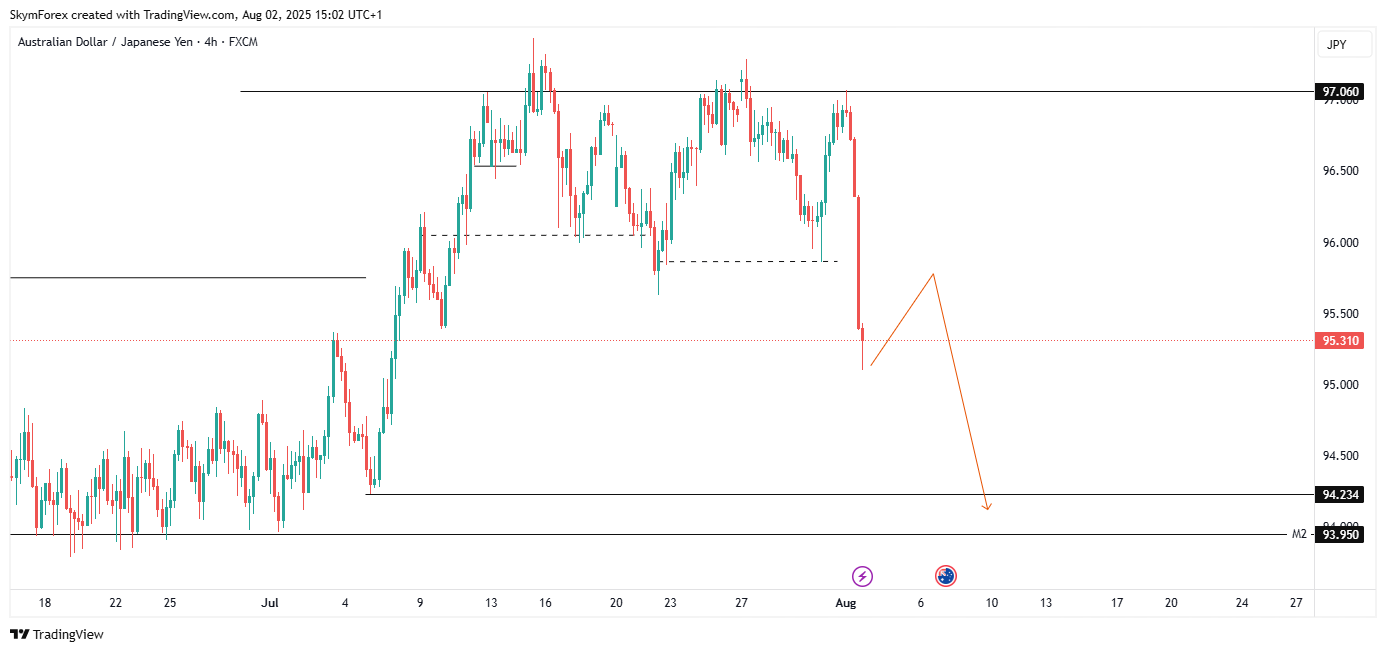

5. AUDJPY

AUDJPY has been sprinting like it’s headed for Olympic gold, but let’s be honest, that 96.000 level? It’s a banana peel.

AUDJPY: 4-HOUR CHART

Expect a graceful pullback there before it trips and falls into a bearish slide.

Setup Thoughts:

Watch for exhaustion candles around 96.000

Fundamentals (China, risk-off flows) might finally tap the brakes on this rally

Enter only if the technicals start throwing shade

This pair’s been flexing for too long. Time for the ego check.

Let’s wrap it:

Fakeouts will still happen.

Your SL might still get tickled.

And the market still doesn’t care that it’s your rent money.

But with smart setups and zero delusion, this week might just be different.

See you on the charts,

– Mr. Pips

Chief Trader, Bonus Distributor

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary