- WMarkets Insider

- Posts

- Life no balance, but these trades might.

Life no balance, but these trades might.

From gala hawkers to gold reversals, Mr. Pips breaks down four setups that survived Lagos chaos and market noise.

From the Desk of Mr. Pips

Lagos is a paradox.

It’s the only city where you can wake up rich, and by 9am — you’re standing in a muddy gutter, holding your slippers in one hand and your pride in the other.

Let me explain.

One morning, I saw a man in a clean suit driving a Benz stop at a junction.

Out of nowhere, a hawker selling gala and bottled water leaned in and said:

“Oga, your tyre no balance. Life no dey balance too.”

He wasn't lying.

Because in Lagos, things switch fast.

The generator that was humming five minutes ago is now smoking.

The okada man who greeted you politely yesterday just tried to run you off the road.

And the same POS operator that charged you ₦100 for ₦2,000 yesterday now says:

“Oga, network no dey — come back by 4pm.”

That’s Lagos for you.

One big, unpredictable dance of chaos and brilliance.

And the market? It’s no different.

One minute, your setup is clean.

The next, Powell drops a hawkish comment, and the dollar moves like NEPA just restored light.

If you’re not watching the story behind the candles, you’ll get bounced around like a danfo without brakes.

So, as always — I’ve mapped out this week’s story.

Not just the price… but the why behind the move.

Let’s get into it

Trade Setups to Watch This Week

1. NZDUSD – Bounce from Rock Bottom

NZDUSD 1-HOURLY CHART

Bias: Long

Key Zone: 0.6044 demand zone

Target: 0.6155–0.6160

Narrative:

Kiwi’s been punished by weak China data and a strong dollar — but we’re at a zone where smart money might re-enter.

A W-formation and a liquidity sweep below support suggest a bounce is coming.

Watch for a clean bullish close above 0.6060 to ride this move up.

2. CADJPY – Fakeout Then Fade

CADJPY 1-HOURLY CHART

Bias: Short

Key Zone: 106.80 resistance (liquidity trap)

Target: 105.15

Narrative:

CAD moved up with oil’s recovery — but oil’s fundamentals are shaky.

JPY is attracting capital as a risk hedge again.

The pair swept the highs, and now price is hesitating.

A rejection from this zone could start the drop. Smart money may have already offloaded.

3. XAUUSD (Gold) – The Crown Feels Heavy

XAUUSD 1-HOURLY CHART

Bias: Short

Key Zone: 3375–3380 (M3 pivot + trendline resistance)

Target: 3240

Narrative:

Gold climbed on dollar weakness… but that was temporary.

Now, real yields are rising and fundamentals favor the dollar again.

This looks like the final push before a hard reversal.

Look for reversal signals around 3375–3380. If price breaks, we ride it down fast.

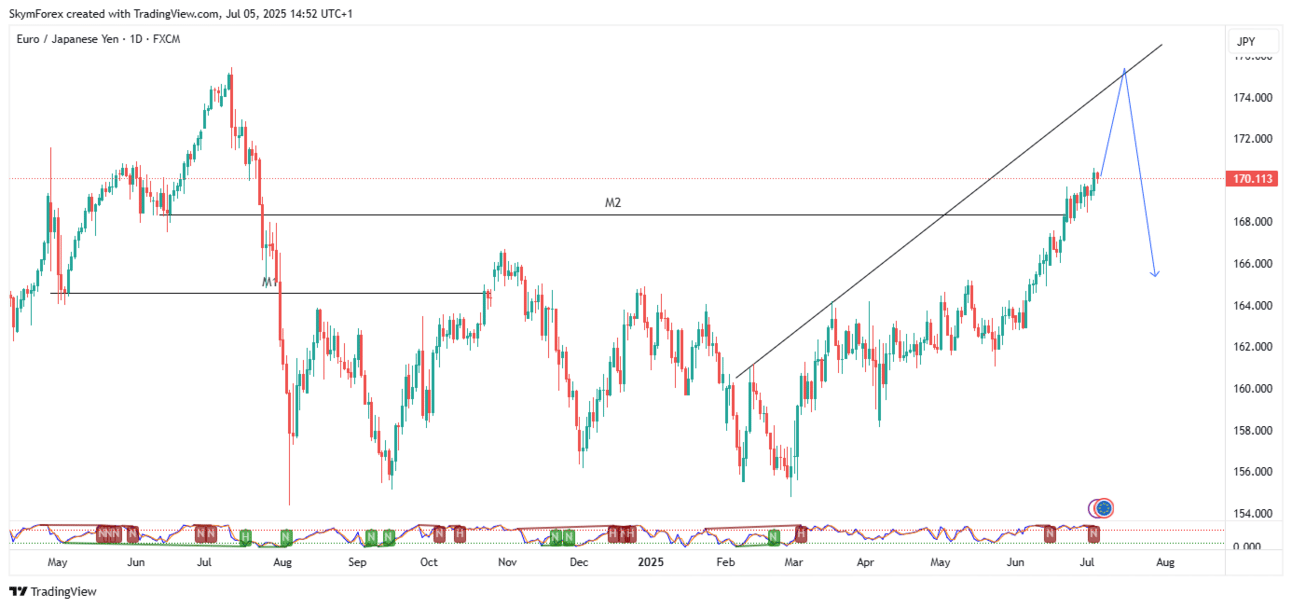

4. EURJPY – Long the Trap, Then Flip the Script

EURJPY 1-DAILY CHART

Bias: Long to 174.30, then Short from 174.30+

Key Zone: 173.50 (entry) → 174.30 (liquidity sweep zone)

Target: 171.80 after reversal

Narrative:

EURJPY has that “Lagos market pickpocket” energy right now.

It’s pulling in buys just below resistance… only to trap them up top.

Here’s how we play it like a Lagos hustler:

✅ First, ride the bus — long into 174.30, where stop losses are sitting.

🚨 Then, when the bus reaches the last bus stop — flip short when you see exhaustion.

What to watch:

Long scalp from 173.50 to 174.30

Look for bearish engulfing or a clear rejection above 174.30

Once confirmed, short it down to 171.80

In Lagos, sometimes you have to ride with the thief to catch the thief. Same thing here — long the trap, then catch the reversal.

🧾 Summary Table

Pair | Bias | Key Zone | Target | Trigger to Watch |

|---|---|---|---|---|

NZDUSD | Long | 0.6044 demand | 0.6155–0.6160 | Bullish close above 0.6060 |

CADJPY | Short | 106.80 resistance | 105.15 | Rejection + bearish momentum candle |

XAUUSD | Short | 3375–3380 resistance | 3240 | Reversal signal near pivot/confluence |

EURJPY | Long → Short | Long from 173.50 to 174.30, then short from 174.30+ | 171.80 (after short) | Bullish scalp to 174.30 → bearish engulfing at highs |

Final Word from Mr. Pips

Don’t let the noise distract you.

Whether you’re dodging danfos or news events, the principle stays the same:

Wait. Watch. Strike only when the conditions favour you.

I’ll be monitoring these four setups closely this week, and if any of them flip, I’ll update the plan. Until then:

Trade like a Lagos survivour — sharp eyes, steady hands, no assumptions.

— Mr. Pips

Lead Analyst, WMarkets

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary