- WMarkets Insider

- Posts

- Just Like That - The Bus Stopped Midway

Just Like That - The Bus Stopped Midway

The market and Lagos bus drivers have one thing in common: they stall when you least expect it.

From the Desk of Mr. Pips

Dear Trader,

There’s a lesson the streets of Lagos will teach you long before the charts ever will:

Things break down, when you're almost sure they won't.

Let me paint you a picture.

This morning, I boarded a bus at Oshodi. The conductor was screaming,

"Last one, Obalende straight! No stopping, no delay!"

We entered.

Barely 10 minutes into the trip, while stuck in traffic near Stadium, the bus coughed, like a man with pneumonia.

Then silence.

The driver twisted the key. Nothing.

Suddenly he turned, beat his dashboard like it owed him money and said:

“Engine don knock. Everybody come down.”

And like that, 18 passengers became roadside philosophers.

That’s Lagos.

And that’s the market too.

The same pair that was trending beautifully last week?

Now it’s consolidating like passengers stalling the driver to refund their fares.

The breakout you’ve been waiting for? Suddenly fakes out, traps you, and vanishes.

The lesson?

The market is a Lagos public bus — it can break down anywhere. Your job is to plan for the breakdowns and profit from the rebounds.

And this weekend, I’ve spotted four key setups that look like they're either about to stall… or explode.

Let’s get into it.

4 Key Setups For Next Week

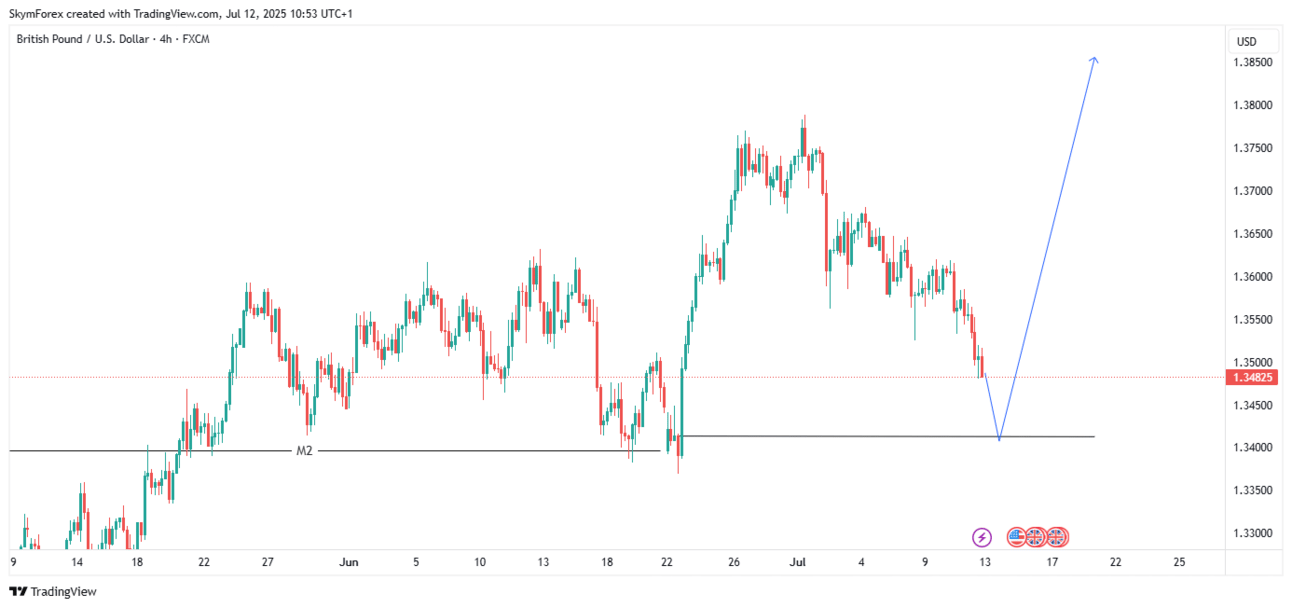

1. GBPUSD – Patience Before The Push

GBPUSD 4-HOURLY CHART

Current Price: 1.3732

Bias: Long (but not yet)

Most traders shorted GBPUSD after it tapped 1.3741 thinking it was overbought.

But look closely…

The market simply created an inducement - a fake-out to lure in early sellers.

There’s clean liquidity resting below the 1.3611 zone. That’s where the market wants to go first to trap buyers and take their stops, before launching the real move.

That’s why I’m not buying yet.

I’m waiting for the dump, then the pump.

Let it dip. Let it sweep. Let the real entry present itself.

When we enter, we’re catching the express bus, not the one with smoke under the bonnet.

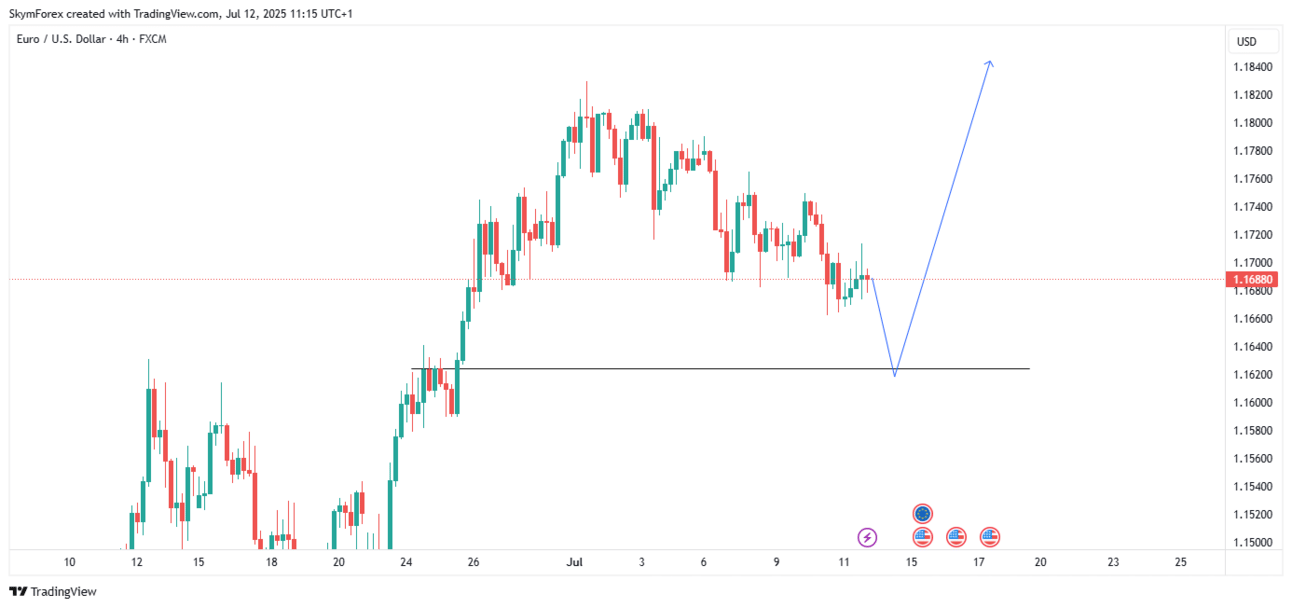

2. EURUSD – Liquidity Pool in Sight

EURUSD 4-HOURLY CHART

Current Price: 1.1688

Bias: Long (but not yet)

We’re nearing a high-probability demand zone around 1.1620.

The dollar’s strength is losing steam: CPI disappointed, and euro data is neutral.

Price is dancing around 1.1680 but the real story lies a few pips below.

There’s resting liquidity at 1.1620, a clear imbalance that price needs to revisit.

This isn’t a reversal yet. It’s an inducement trap designed to flush out retail longs before lifting.

Once price sweeps that level, expect a V-shaped bounce back to 1.1770… maybe higher.

If you jump in now, you might be the liquidity. Let the market come to you.

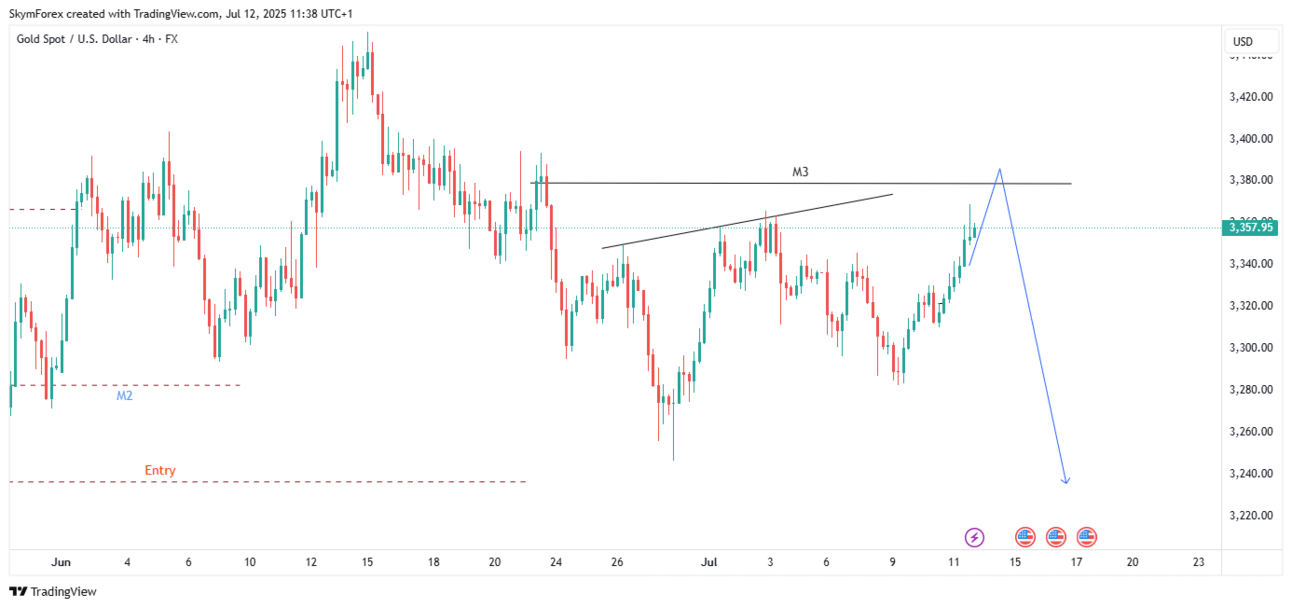

3. XAUUSD – The Setup for a Golden Fade

XAUUSD 4-HOURLY CHART

Current Price: 3,357.95

Bias: Short

Gold is parading upward, heading into the 3375–3380 resistance area.

But don’t be fooled.

This pump is engineered to grab buy stops above the previous highs.

A rising wedge is forming, and gold is about to complete its inducement structure.

After that?

Massive rejection.

There’s an empty zone below 3240 and that’s the magnet.

The move looks bullish, but the game is bearish. Be smarter than the trap.

4. GBPCHF – Reversal in Progress

GBPCHF 4-HOURLY CHART

Current Price: 1.0724

Bias: Long

This one’s been bleeding for weeks, creating a false narrative of endless bearishness.

But here’s what I see:

A liquidity sweep just completed below 1.0720, a major M3 pivot zone.

Now that all the early buyers have been cleaned out, price is preparing to reverse with velocity.

I’m already watching for a strong break of structure back to the upside.

This is a textbook reaccumulation move after stop hunt, and it’s gearing up for a run to 1.0950 and beyond.

A Quick Note Before You Trade...

If your account’s been coughing like that danfo’s engine lately —

If you've spotted the setups but lacked the room to enter…

Fix that now.

We’re giving you 100% more firepower with our July Deposit Bonus.

That’s real capital. Real margin. Real fuel.

Let the rest of the market argue with the driver.

You? You're on the next ride. Full tank. No breakdowns.

Mr. Pips

Lead Analyst, WMarkets

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary