- WMarkets Insider

- Posts

- He saw the trap, and set his own

He saw the trap, and set his own

Sometimes the smartest trade is letting it come to you...

From the Desk of Mr. Pips

He waited for the crowd to get greedy.

Back in 2022, a trader in my inner circle spotted something off with NASDAQ.

The headlines were bullish. Twitter was full of hopium. Tech bros were back.

But he knew the game.

“They’re about to run buy-side liquidity before the real move.”

So, he did the hardest thing in trading…

He waited.

While others chased the breakout, he marked his level.

And when price spiked into premium, he shorted with conviction.

That one trade paid for a down payment on a duplex in Lekki.

This week, I’m seeing the same script forming in GBPJPY, GBPUSD, and NASDAQ.

Price is hunting liquidity. The trap is nearly set.

Let me show you where I plan to strike.

PAIR 1: GBPJPY — Bearish Bias

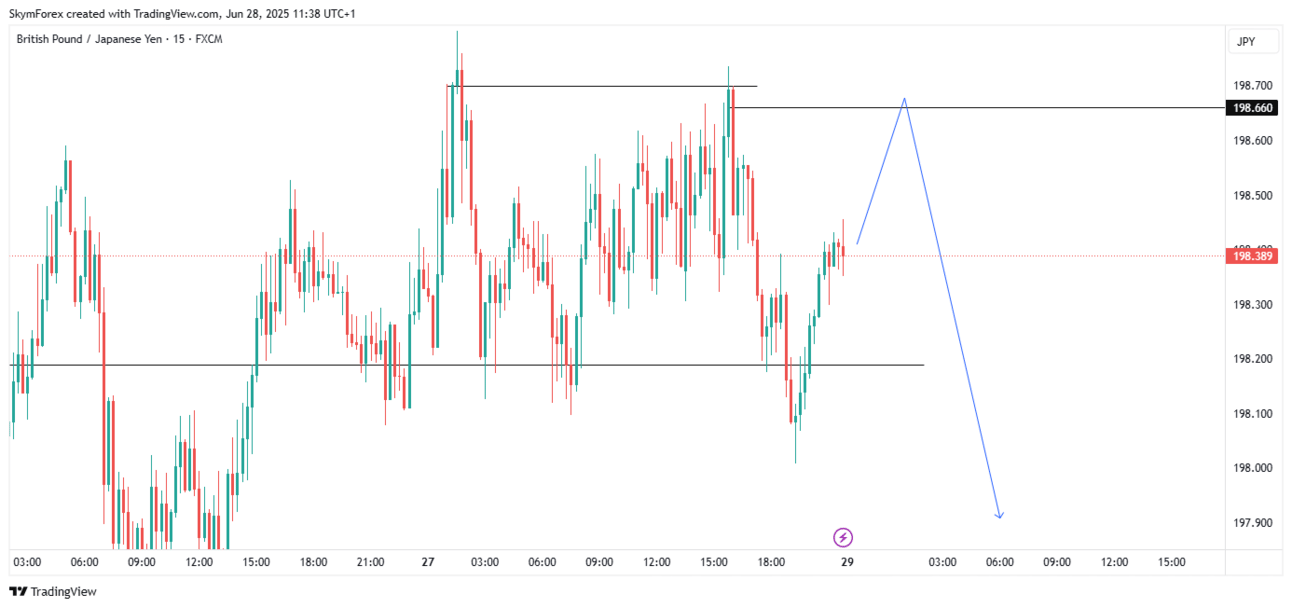

GBPJPY 15-MINS CHART

1. GBPJPY: Sell the Buy-Side Sweep

Sell Zone: 198.660

Target: 197.300 → 196.400

📈 Liquidity Technicals:

Price is approaching a clear buy-side liquidity pool resting above 198.400.

Institutional candles left behind on 4H — unmitigated supply around 198.660.

Equal lows at 196.400 = high-probability magnet if price reverses after sweep.

🌍 The Narrative: “Japan’s Currency War is Quiet, But Strategic”

Japan has been intervening subtly, not through rate hikes but direct market operations.

The Ministry of Finance doesn’t want yen collapse, especially with energy imports climbing.

Meanwhile, UK inflation remains sticky, but BoE is politically pressured to pause hikes.

Add slowing growth and weak PMI data last week?

It’s a ticking time bomb for GBP strength.

So here’s the trap:

Retail sees JPY weakness and piles into longs — just as the market sets them up for a stop-run.

📉 My Bias: Let price sweep 198.660, then enter short on rejection.

Target the equal lows.

2. GBPUSD: Sell From Premium, Ride to Discount

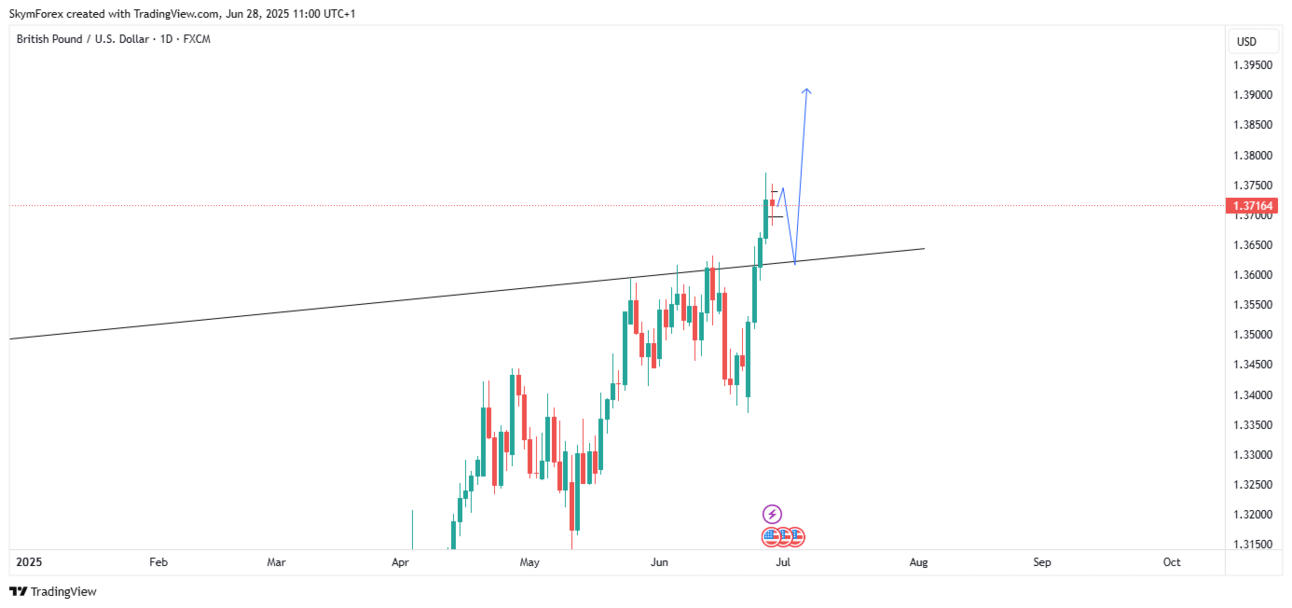

GBPUSD 1-DAILY CHART

Sell Entry: 1.37419

Target: 1.36110

📈 Liquidity Technicals:

Price has filled inefficiency between 1.37000–1.37400.

Clean internal liquidity swept at 1.37200 — perfect point for institutional short re-entries.

Below 1.36110 lies clean sell-side liquidity from early June.

🌍The Narrative: “The Dollar Ain’t Dead Yet”

Everyone’s pricing in Fed cuts.

But Jerome Powell isn’t blinking.

He’s watching sticky inflation and reminding markets: “We’re not done yet.”

Meanwhile, the UK economy is in political and economic limbo:

Surprise drop in GDP growth

Household spending slowing

Labour market cooling faster than expected

The USD may have been weak... but it’s the lesser of two risks right now.

📉 My Bias: Sell from 1.37419. That’s premium.

Target 1.36110 — that’s discount. Trade smart.

3. NASDAQ — The Last Liquidity Sweep Before the Drop

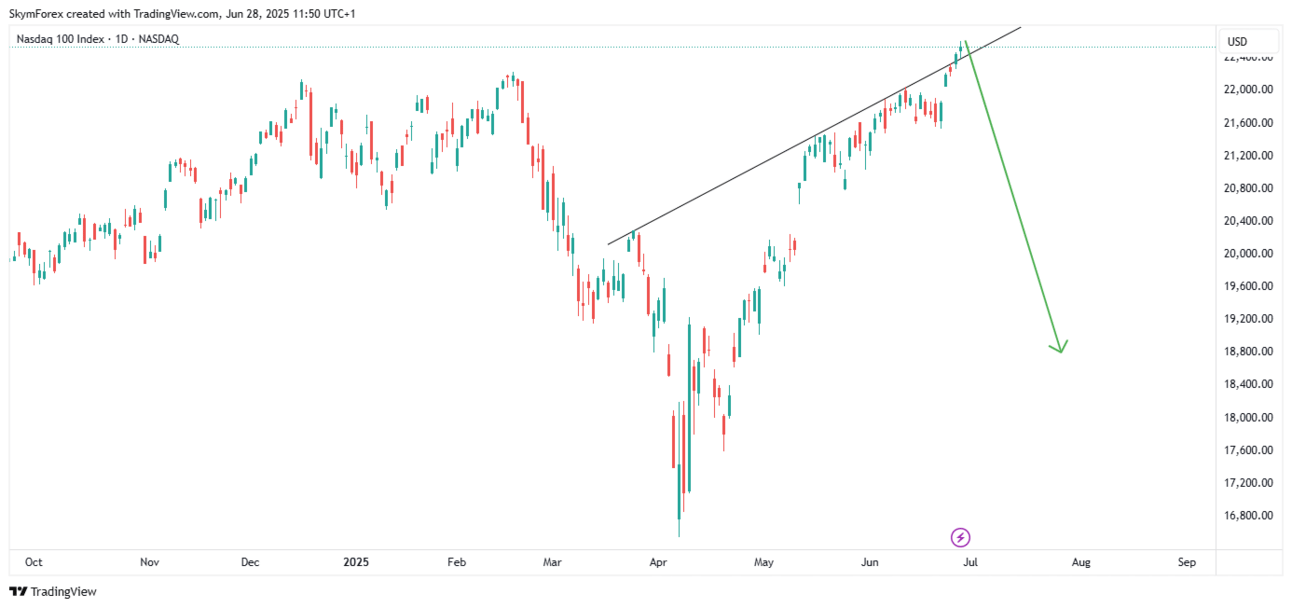

NASDAQ 1-DAILY CHART

Sell Zone: 22534

Target: 22010 → 21700

📈 Liquidity Technicals:

Buy-side liquidity sits at 22500–22534: a level that has trapped buyers twice this month.

Price has left behind FVG (fair value gap) from 22100 to 21800 — magnet for rebalancing.

Divergence forming between price and internal liquidity — market maker behavior.

Just battle-tested ideas, real trader stories, and stuff you can actually use to get better.

🌍 The Narrative: “The Tech Bubble is Now Running on Fumes”

NVIDIA and Apple gave the illusion of strength, but under the hood?

Small caps are lagging

Bond yields are rising

Corporate debt costs are creeping back up

And the Fed is not in a cutting mood

That means tech valuations have to compress.

Especially after this week’s PCE data showed inflation isn’t dead yet.

The higher-for-longer narrative is back — and it’s going to hurt growth stocks.

📉 My Bias: Watch for buy-side sweep near 22534.

Once it fakes the breakout — hit sell. Target rebalancing zones below.

Final Word

These aren’t just setups.

These are liquidity hunts dressed as breakouts.

The kind of market structure that traps 90% of traders... and pays the 10% who wait.

You now know where I’ll be watching.

Let the crowd chase the bait — we’ll take the real move.

See you inside the charts.

— Mr. Pips

Lead Analyst, WMarkets

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary