- WMarkets Insider

- Posts

- 100% Bonus Ends August 4 - These 3 Setups Could Fund It

100% Bonus Ends August 4 - These 3 Setups Could Fund It

Trade smart, scale fast. EURUSD, GBPJPY, and CADJPY are giving clues, but only to those who look deeper.

Tesla Was Always Right - But Nobody Listened

Nikola Tesla died in a small New York hotel room -alone, broke, and mostly forgotten.

The man who envisioned wireless energy before the world had electricity…

The man who saw patterns in storms, rhythms in silence, and potential in things others dismissed…

He was constantly ahead of his time, and painfully misunderstood.

That’s exactly how the market feels this week.

Everyone’s staring at the candles. Everyone’s waiting for confirmation. But they don’t see what’s beneath the chart.

Across CADJPY, GBPJPY, and EURUSD, there’s a strange silence. A coiling tension.

Like Tesla’s final days, when the world had moved on, but the truth was still there, waiting.

What we’re seeing now:

CADJPY is pulsing at a manipulated resistance, it wants you to act prematurely.

GBPJPY is setting a clean trap, and it’s working, drawing in both bulls and bears.

EURUSD is whispering false direction, right before the real move begins.

The market has always moved like this. Not with logic. With inducement, manipulation, liquidity grabs.

And only those who understand human behaviour beneath the candles ever profit.

Tesla understood waves, not just electricity, but how energy builds silently before release.

The market? Same thing.

If you’re emotional, you’ll enter too early.

If you’re desperate, you’ll believe the lie.

But if you wait… like Tesla did… long enough… the move reveals itself.

Let’s break down what’s really happening, technically and fundamentally on CADJPY, GBPJPY, and EURUSD.

Because when the rest of the world sees confusion, Mr. Pips sees inevitable precision.

TRADE SETUPS BREAKDOWN

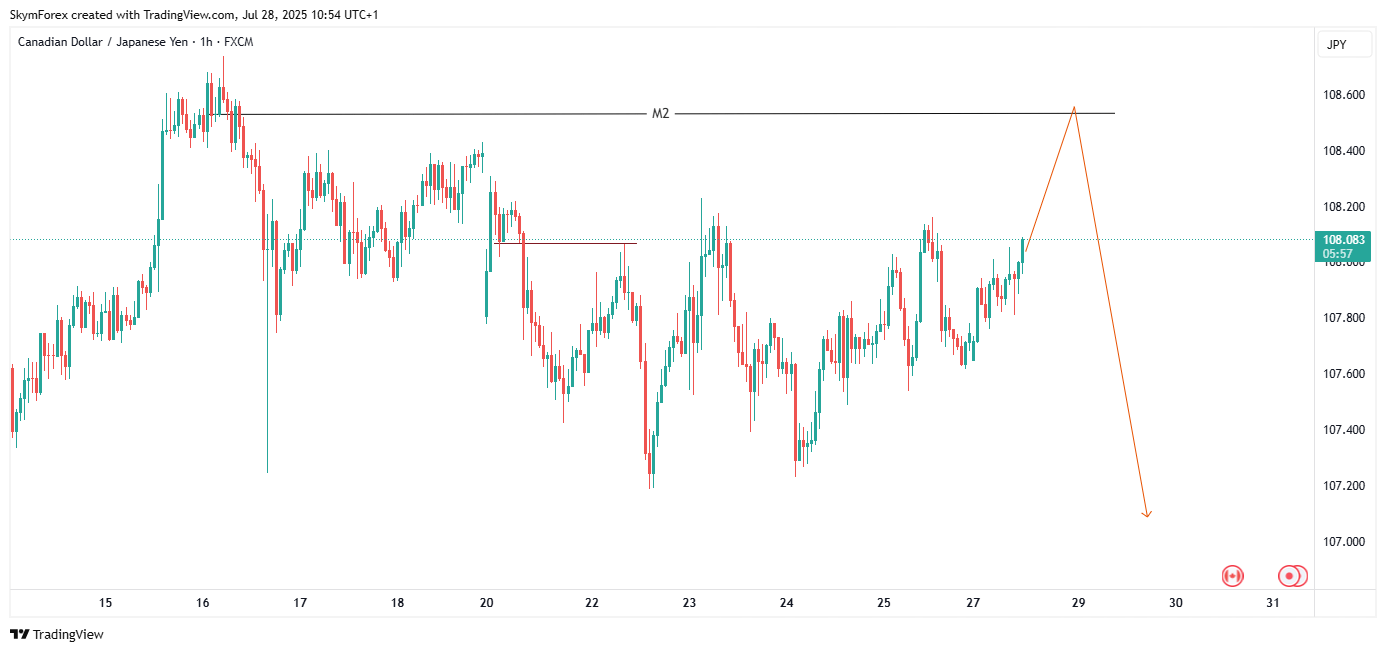

1. CADJPY – The Quiet Voltage Before the Shock

Tesla once said:

“If you want to find the secrets of the universe, think in terms of energy, frequency and vibration.”

That’s exactly what CADJPY is doing right now.

CADJPY: 1HR CHART

It’s vibrating at a frequency most retail traders can’t detect, consolidating at a familiar resistance. But what feels like a breakout forming is more like a trap being engineered.

Technically:

Price has wicked into a key supply zone, but the structure hasn’t broken. Liquidity was taken above a recent high, only for price to retreat into the zone with decreasing volume. This is textbook inducement.

Fundamentally:

CAD is currently under macroeconomic pressure from slowing inflation data, while JPY gains haven’t been sustained due to Japan’s own internal uncertainty. That’s the illusion; both currencies look weak, which means the real pressure lies in the hands of the banks, not in the news.

Expect a fake push higher… before a true rejection back into imbalance.

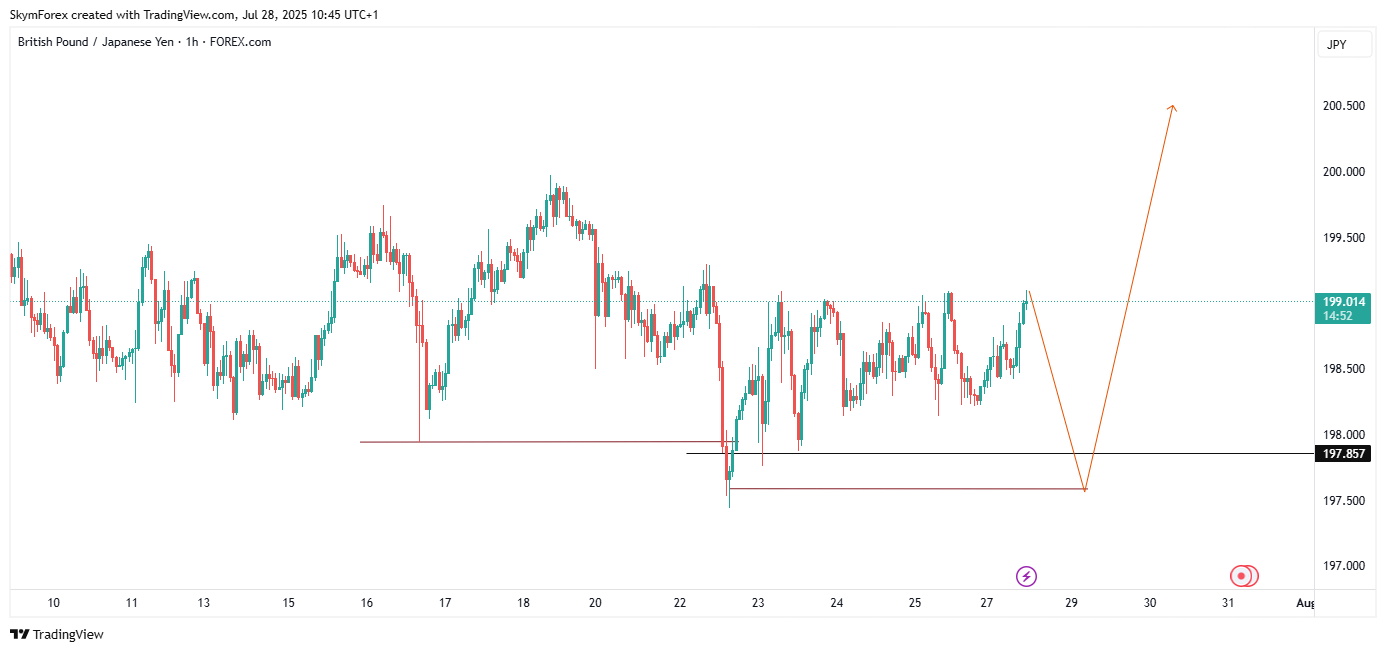

2. GBPJPY – The Invention Everyone Ignored

Tesla gave us AC electricity, but the world chased Edison’s DC hype.

GBPJPY feels the same; massively misunderstood, but hiding undeniable force.

GBPJPY: 1HR CHART

Technically:

The pair is dancing along a major H4 POI (Point of Interest). Multiple liquidity sweeps have already occurred; highs taken, lows manipulated, yet no clean move has followed. This is intentional.

It’s a setup for the classic POI reaction:

A minor inducement to attract late entries

A deep reaction with momentum from sponsored volume

Then a swift directional move once retail is confused

Fundamentally:

The pound is stuck in a tug of war:

BoE hints at possible rate pauses

Japan’s inconsistent interventions confuse sentiment

Volatility is high, but direction is intentionally delayed.

Be patient. The fake move is the smoke. The real trade comes after the misfire.

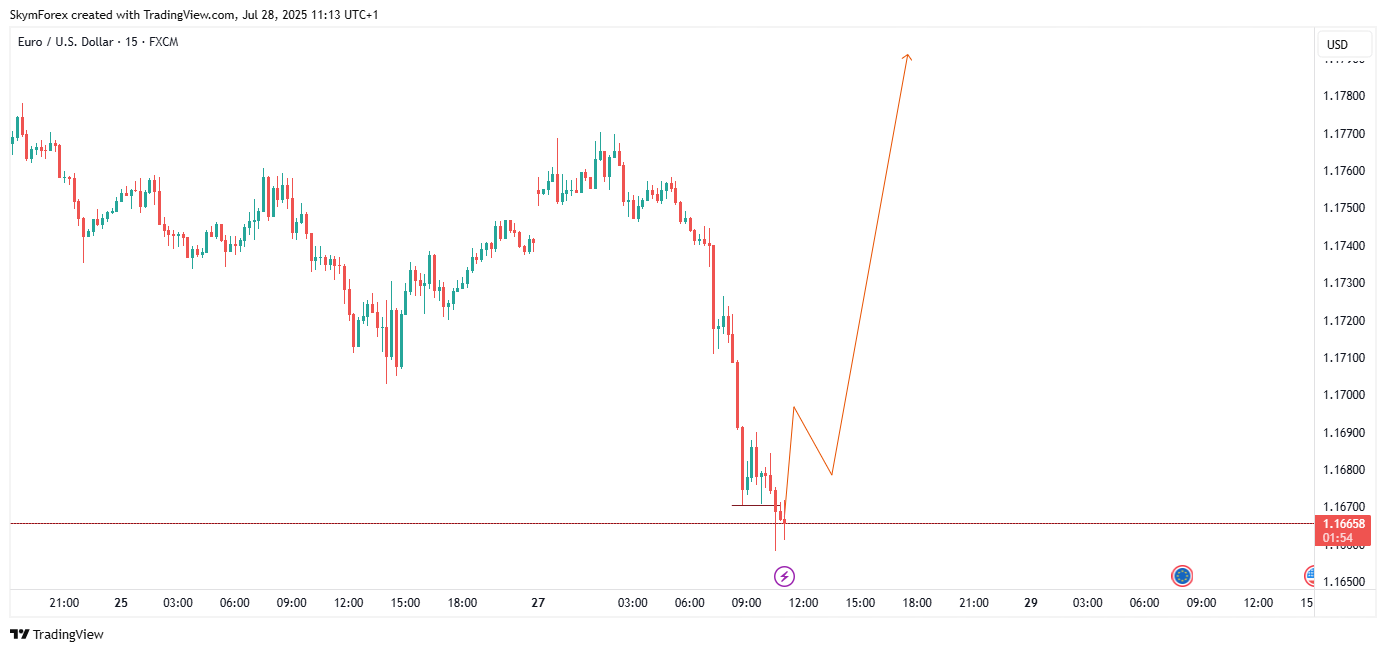

3. EURUSD – The Signal That Nobody Believed

Tesla once built a radio-controlled boat in 1898, before most people even believed wireless tech was real.

EURUSD is delivering a signal now. Most will ignore it.

But it’s there, clear as day.

EURUSD: 15-MINS CHART

Technically:

EURUSD just completed a clean liquidity grab below a key support structure. But unlike most fakeouts, this one left behind an unfilled imbalance and tapped into a bullish order block from early July.

Smart money knows: the downside move was a setup, not a trend.

Fundamentally:

USD is gaining temporarily due to risk-off sentiment

But Eurozone PMI data and ECB remarks are quietly supportive

This pair is building for mean reversion, not collapse.

Look for signs of reaccumulation. The crowd thinks it's dead, which is when it usually revives.

In Tesla’s world, the future was already here, just hidden in plain sight.

That’s what this week looks like:

CADJPY is buzzing with bait.

GBPJPY is mid-invention, misunderstood, but powerful.

EURUSD is sending a signal, if you’re tuned in.

Let’s monitor. Let’s wait. Then strike.

Because like Tesla said…

“The present is theirs; the future, for which I really worked, is mine.”

Also, don’t forget, the 100% Deposit Bonus starts today and ends August 4.

Stack your edge. Stack your capital.

Trade smart.

Trade deliberate.

From the Desk of Mr. Pips

Your guide in the chaos.

Trading foreign exchange (Forex) and leveraged financial instruments involves a high level of risk and may not be suitable for all investors. Before deciding to trade with WMarkets, you should carefully consider your financial goals, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not trade with money you cannot afford to lose.

Past performance is not indicative of future results. WMarkets does not guarantee any profits or protection from losses. Please ensure you fully understand the risks involved and seek independent financial advice if necessary